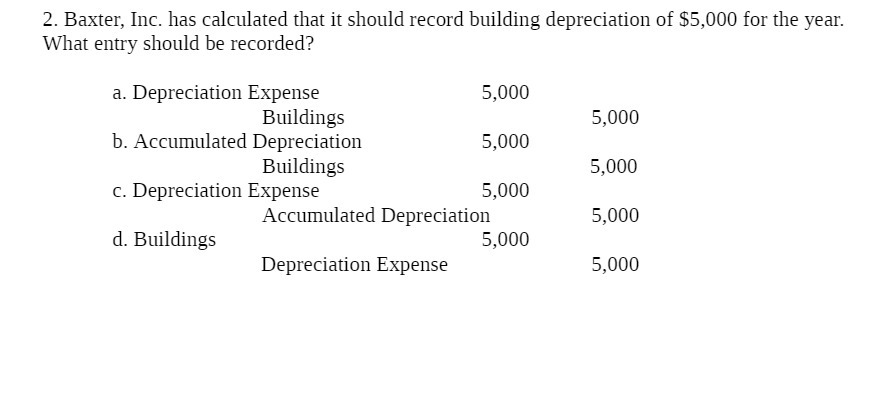

Question: 2. Baxter, Inc. has calculated That it should record building depreciation of $5,000 for the year. What entry should he recorded? a. Depreciation Expense 5,000

2. Baxter, Inc. has calculated That it should record building depreciation of $5,000 for the year. What entry should he recorded? a. Depreciation Expense 5,000 Buildings 5,000 b. Accumulated Depreciation 5,000 Buildings 5,000 c. Depreciation Expense 5,000 Accumulated Depreciation 5,000 d. Buildings 5,000 Depreciation Expense 5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts