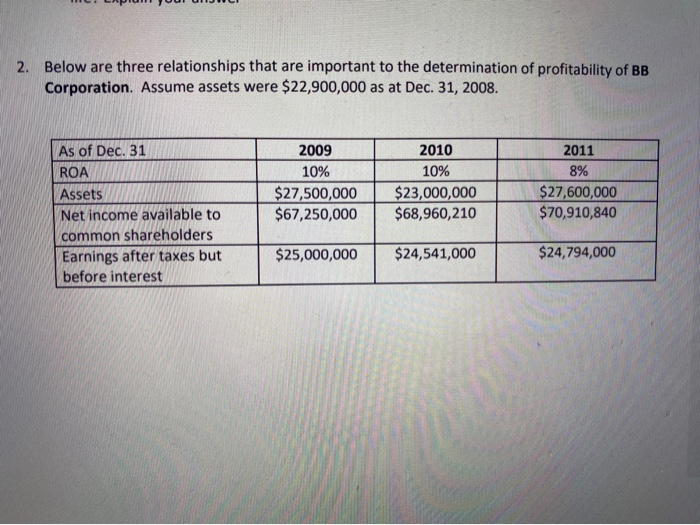

Question: 2. Below are three relationships that are important to the determination of profitability of BB Corporation. Assume assets were $22,900,000 as at Dec. 31, 2008.

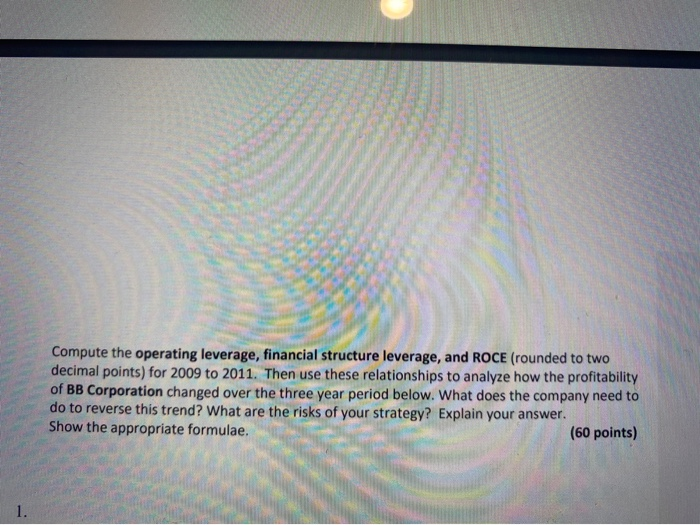

2. Below are three relationships that are important to the determination of profitability of BB Corporation. Assume assets were $22,900,000 as at Dec. 31, 2008. As of Dec. 31 ROA Assets Net income available to common shareholders Earnings after taxes but before interest 2009 10% $27,500,000 $67,250,000 2010 10% $23,000,000 $68,960,210 2011 8% $27,600,000 $70,910,840 $25,000,000 $24,541,000 $24,794,000 Compute the operating leverage, financial structure leverage, and ROCE (rounded to two decimal points) for 2009 to 2011. Then use these relationships to analyze how the profitability of BB Corporation changed over the three year period below. What does the company need to do to reverse this trend? What are the risks of your strategy? Explain your answer. Show the appropriate formulae. (60 points) 1. 2. Below are three relationships that are important to the determination of profitability of BB Corporation. Assume assets were $22,900,000 as at Dec. 31, 2008. As of Dec. 31 ROA Assets Net income available to common shareholders Earnings after taxes but before interest 2009 10% $27,500,000 $67,250,000 2010 10% $23,000,000 $68,960,210 2011 8% $27,600,000 $70,910,840 $25,000,000 $24,541,000 $24,794,000 Compute the operating leverage, financial structure leverage, and ROCE (rounded to two decimal points) for 2009 to 2011. Then use these relationships to analyze how the profitability of BB Corporation changed over the three year period below. What does the company need to do to reverse this trend? What are the risks of your strategy? Explain your answer. Show the appropriate formulae. (60 points) 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts