Question: 2. Black, Derman, and Toy binomial short-term interest rate model (40 points) In the Black, Derman, and Toy model, the binomial tree of the 6-month

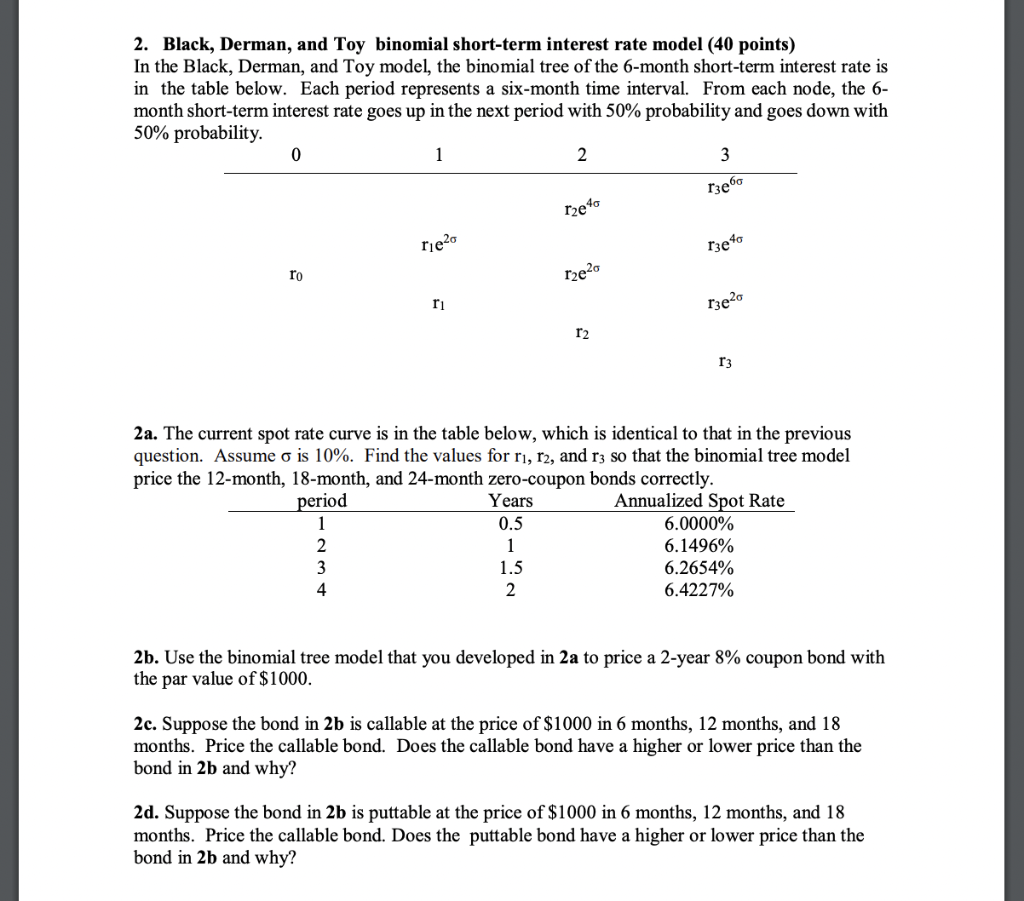

2. Black, Derman, and Toy binomial short-term interest rate model (40 points) In the Black, Derman, and Toy model, the binomial tree of the 6-month short-term interest rate is in the table below. Each period represents a six-month time interval. From each node, the 6- month short-term interest rate goes up in the next period with 50% probability and goes down with 50% probability. 0 1 2 3 Teto ne20 13e40 ro r2e26 ri r3e20 r2 r3 2a. The current spot rate curve is in the table below, which is identical to that in the previous question. Assume o is 10%. Find the values for r, r2, and r3 so that the binomial tree model price the 12-month, 18-month, and 24-month zero-coupon bonds correctly. period Years Annualized Spot Rate 1 0.5 6.0000% 2 1 6.1496% 3 1.5 6.2654% 4 2 6.4227% 2b. Use the binomial tree model that you developed in 2a to price a 2-year 8% coupon bond with the par value of $1000. 2c. Suppose the bond in 2b is callable at the price of $1000 in 6 months, 12 months, and 18 months. Price the callable bond. Does the callable bond have a higher or lower price than the bond in 2b and why? 2d. Suppose the bond in 2b is puttable at the price of $1000 in 6 months, 12 months, and 18 months. Price the callable bond. Does the puttable bond have a higher or lower price than the bond in 2b and why? 2. Black, Derman, and Toy binomial short-term interest rate model (40 points) In the Black, Derman, and Toy model, the binomial tree of the 6-month short-term interest rate is in the table below. Each period represents a six-month time interval. From each node, the 6- month short-term interest rate goes up in the next period with 50% probability and goes down with 50% probability. 0 1 2 3 Teto ne20 13e40 ro r2e26 ri r3e20 r2 r3 2a. The current spot rate curve is in the table below, which is identical to that in the previous question. Assume o is 10%. Find the values for r, r2, and r3 so that the binomial tree model price the 12-month, 18-month, and 24-month zero-coupon bonds correctly. period Years Annualized Spot Rate 1 0.5 6.0000% 2 1 6.1496% 3 1.5 6.2654% 4 2 6.4227% 2b. Use the binomial tree model that you developed in 2a to price a 2-year 8% coupon bond with the par value of $1000. 2c. Suppose the bond in 2b is callable at the price of $1000 in 6 months, 12 months, and 18 months. Price the callable bond. Does the callable bond have a higher or lower price than the bond in 2b and why? 2d. Suppose the bond in 2b is puttable at the price of $1000 in 6 months, 12 months, and 18 months. Price the callable bond. Does the puttable bond have a higher or lower price than the bond in 2b and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts