Question: 2. Bond A has $10,000 face value, 6% coupon rate with annual coupon payments, and 3 years left till maturity. Bond B is a zero-coupon

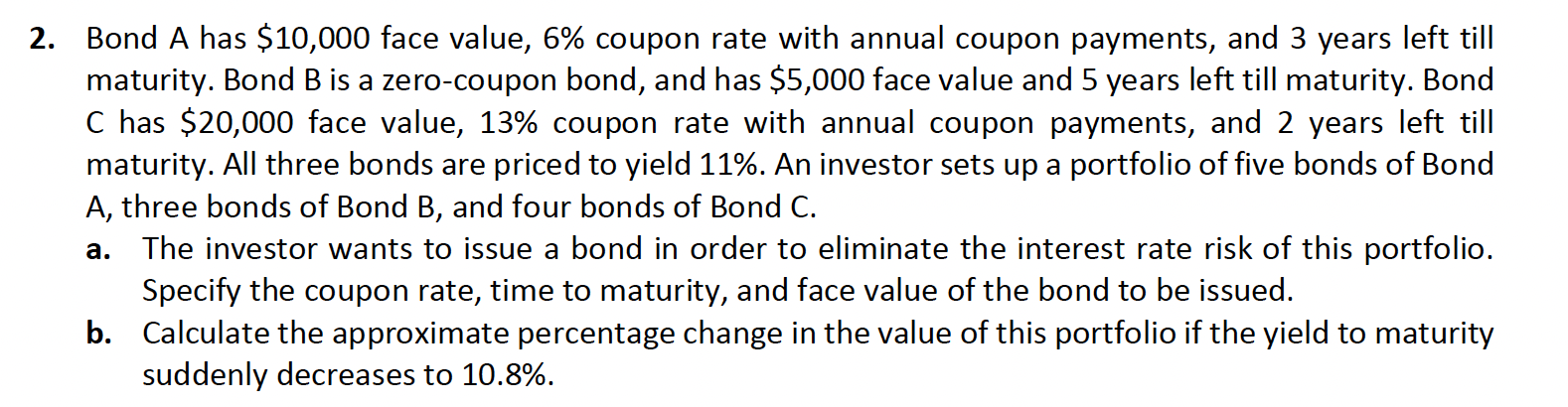

2. Bond A has $10,000 face value, 6% coupon rate with annual coupon payments, and 3 years left till maturity. Bond B is a zero-coupon bond, and has $5,000 face value and 5 years left till maturity. Bond C has $20,000 face value, 13% coupon rate with annual coupon payments, and 2 years left till maturity. All three bonds are priced to yield 11%. An investor sets up a portfolio of five bonds of Bond A, three bonds of Bond B, and four bonds of Bond C. The investor wants to issue a bond in order to eliminate the interest rate risk of this portfolio. Specify the coupon rate, time to maturity, and face value of the bond to be issued. b. Calculate the approximate percentage change in the value of this portfolio if the yield to maturity suddenly decreases to 10.8%. a. 2. Bond A has $10,000 face value, 6% coupon rate with annual coupon payments, and 3 years left till maturity. Bond B is a zero-coupon bond, and has $5,000 face value and 5 years left till maturity. Bond C has $20,000 face value, 13% coupon rate with annual coupon payments, and 2 years left till maturity. All three bonds are priced to yield 11%. An investor sets up a portfolio of five bonds of Bond A, three bonds of Bond B, and four bonds of Bond C. The investor wants to issue a bond in order to eliminate the interest rate risk of this portfolio. Specify the coupon rate, time to maturity, and face value of the bond to be issued. b. Calculate the approximate percentage change in the value of this portfolio if the yield to maturity suddenly decreases to 10.8%. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts