Question: 2 Bond P is a prerium bond with a 9 percent oupon. Bond Dis a 5 percert coupon bond aimently selling at a discount. Both

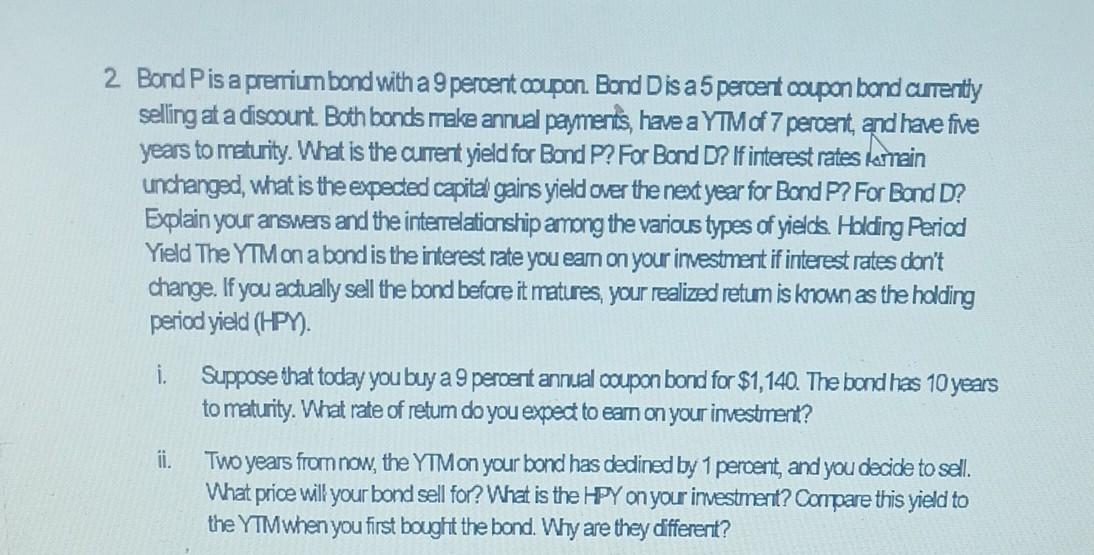

2 Bond P is a prerium bond with a 9 percent oupon. Bond Dis a 5 percert coupon bond aimently selling at a discount. Both bonds make annual payments, have a YTM of 7 percent, and have five years to meturity. What is the currert yield for Bond P ? For Bond D ? If interest rates warmein unchanged, what is the expected capital gains yield over the next year for Bond P? For Bond D? Explain your answers and the interrelationship among the various types of yields. Holding Period Yield The YTMon a bond is the interest rate you eam on your investment if interest rates don't change. If you actually sell the bond before it matures, your realized retum is nown as the holding period yield (HPY). i. Suppose that today you buy a 9 peroent annual coupon bond for $1,140. The bond has 10 years to maturity. What rate of retum do you exped to eam on your investrment? ii. Two years from now, the YTM on your bond has dedined by 1 percent, and you decide to sell. What price will your bond sell for? What is the HPY on your imestment? Compare this yield to the YTM when you first bought the bond. Why are they dffferent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts