Question: 2. Calculation Problems(5 points each) (1) Taylor Company earned $92,500 before taxes during 2016. a. Calculate the firm's tax liability using the tax rate schedule

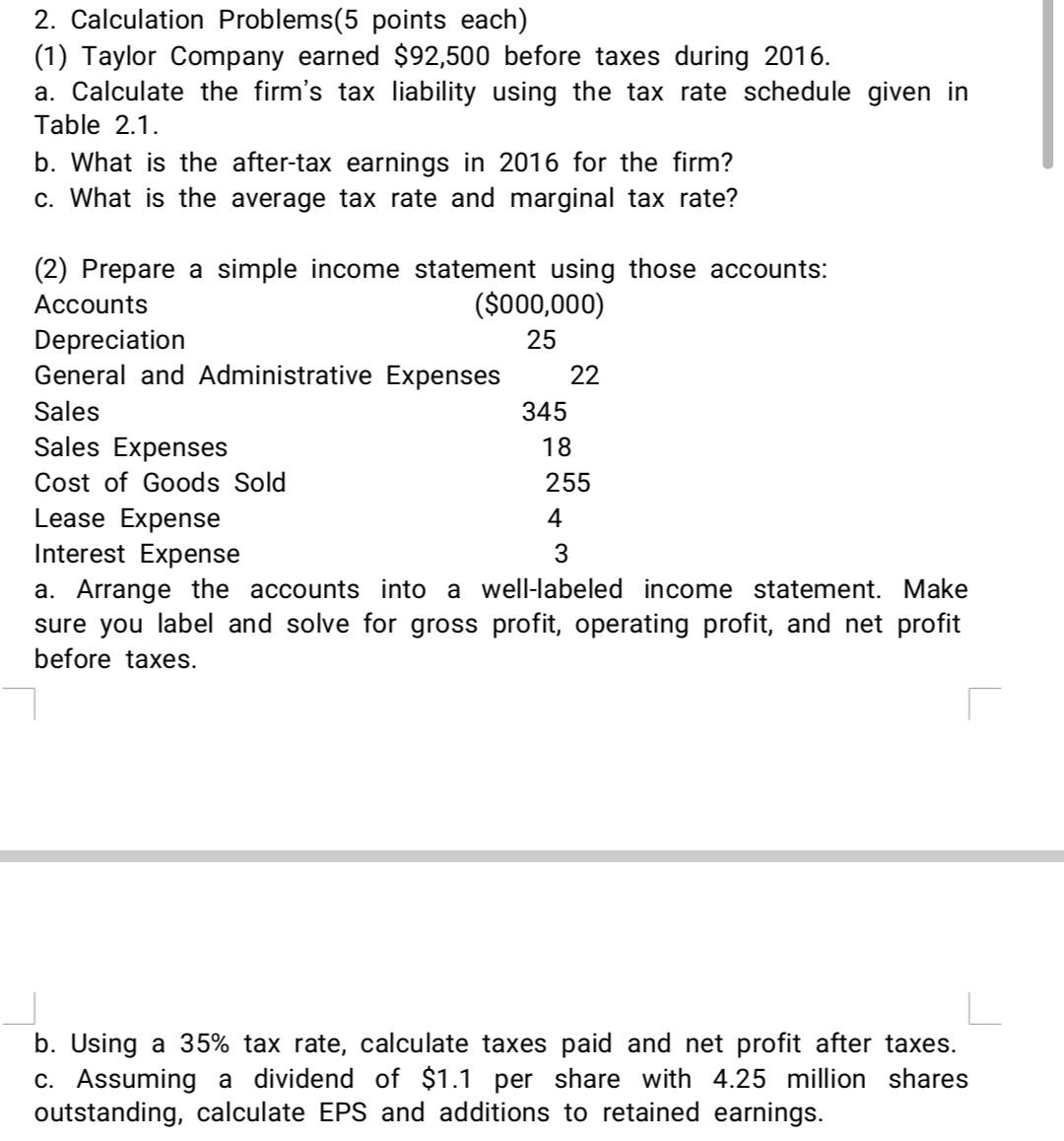

2. Calculation Problems(5 points each) (1) Taylor Company earned $92,500 before taxes during 2016. a. Calculate the firm's tax liability using the tax rate schedule given in Table 2.1. b. What is the after-tax earnings in 2016 for the firm? C. What is the average tax rate and marginal tax rate? 25 (2) Prepare a simple income statement using those accounts: Accounts ($000,000) Depreciation General and Administrative Expenses 22 Sales 345 Sales Expenses 18 Cost of Goods Sold 255 Lease Expense 4 Interest Expense 3 a. Arrange the accounts into a well-labeled income statement. Make sure you label and solve for gross profit, operating profit, and net profit before taxes. b. Using a 35% tax rate, calculate taxes paid and net profit after taxes. C. Assuming a dividend of $1.1 per share with 4.25 million shares outstanding, calculate EPS and additions to retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts