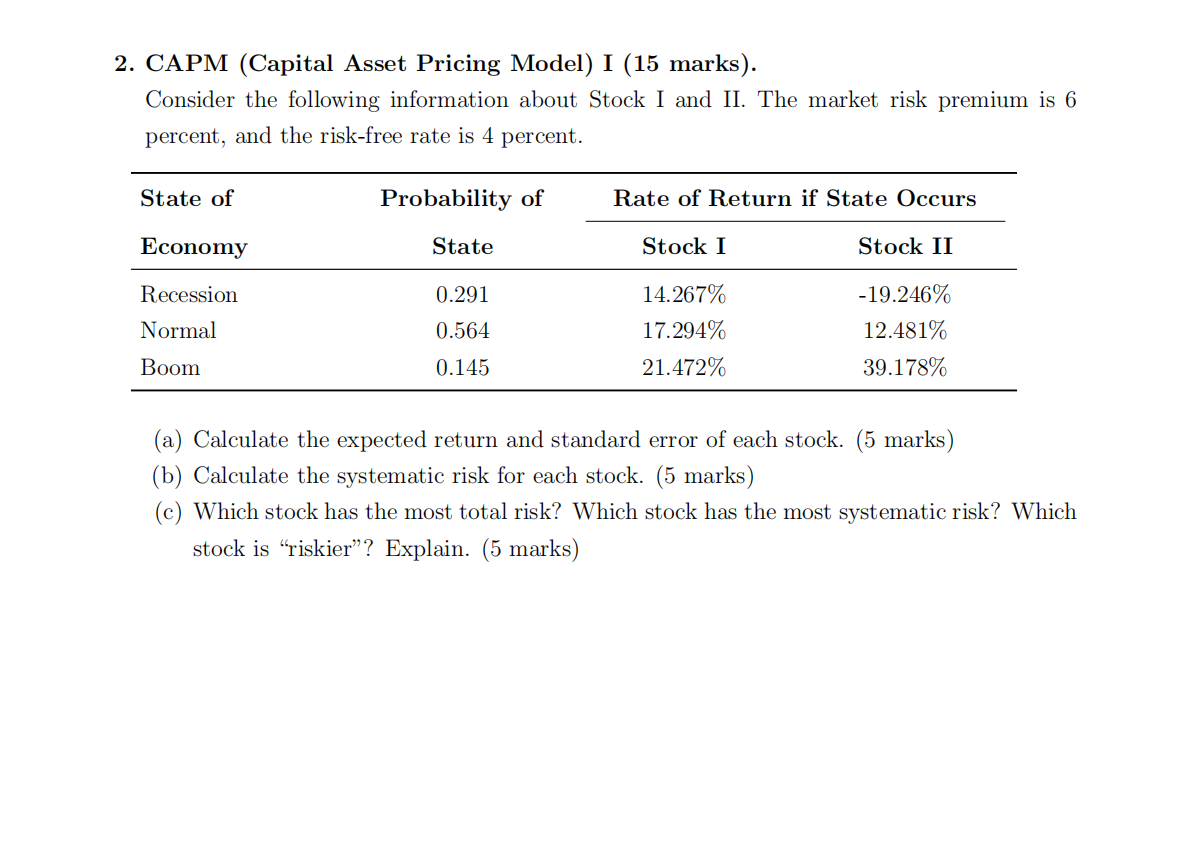

Question: 2. CAPM (Capital Asset Pricing Model) I (15 marks). Consider the following information about Stock I and II. The market risk premium is 6 percent,

2. CAPM (Capital Asset Pricing Model) I (15 marks). Consider the following information about Stock I and II. The market risk premium is 6 percent, and the risk-free rate is 4 percent. State of Probability of Rate of Return if State Occurs Economy State Stock I Stock II 0.291 Recession Normal 14.267% 17.294% 21.472% -19.246% 12.481% 0.564 Boom 0.145 39.178% (a) Calculate the expected return and standard error of each stock. (5 marks) (b) Calculate the systematic risk for each stock. (5 marks) (c) Which stock has the most total risk? Which stock has the most systematic risk? Which stock is riskier? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts