Question: 2. Carefully explain what the impact should be on a bank's ROA and ROE from increased use by a bank of off-balance sheet (OBS)

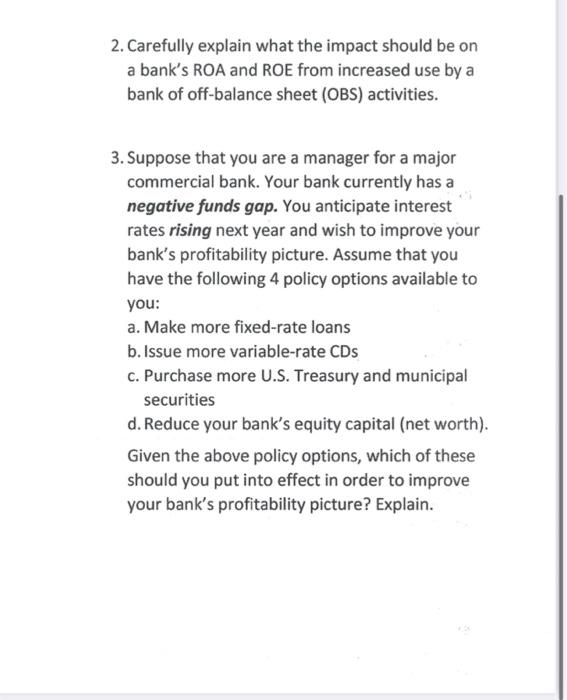

2. Carefully explain what the impact should be on a bank's ROA and ROE from increased use by a bank of off-balance sheet (OBS) activities. 3. Suppose that you are a manager for a major commercial bank. Your bank currently has a negative funds gap. You anticipate interest rates rising next year and wish to improve your bank's profitability picture. Assume that you have the following 4 policy options available to you: a. Make more fixed-rate loans b. Issue more variable-rate CDs c. Purchase more U.S. Treasury and municipal securities d. Reduce your bank's equity capital (net worth). Given the above policy options, which of these should you put into effect in order to improve your bank's profitability picture? Explain.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts