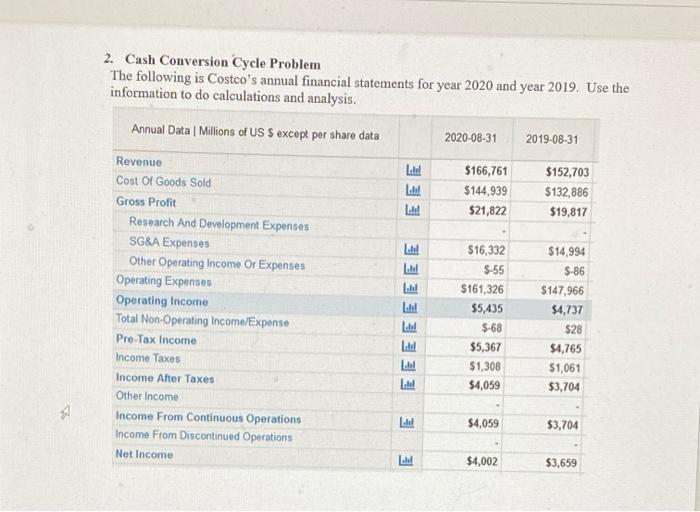

Question: 2. Cash Conversion Cycle Problem The following is Costco's annual financial statements for year 2020 and year 2019. Use the information to do calculations and

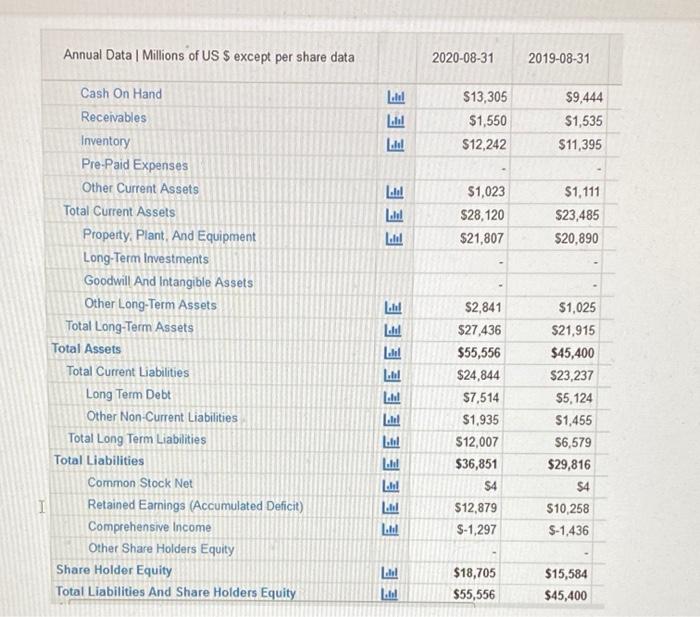

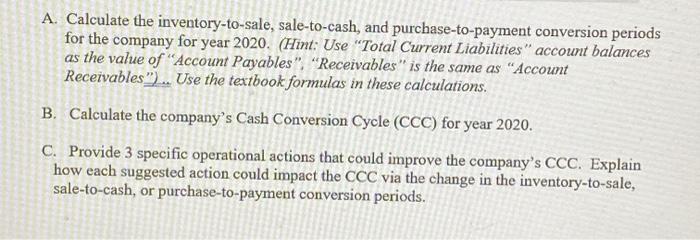

2. Cash Conversion Cycle Problem The following is Costco's annual financial statements for year 2020 and year 2019. Use the information to do calculations and analysis. Annual Data Millions of US $ except per share data 2020-08-31 2019-08-31 EEE $166,761 $144,939 $21,822 $152,703 $132,886 $19,817 Revenue Cost Of Goods Sold Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Income Taxes Income After Taxes Other Income Income From Continuous Operations Income From Discontinued Operations Net Income EEEEEEEE $16,332 $-55 $161,326 $5,435 $-68 $5,367 $1,308 $4,059 $14,994 S-86 $147,966 $4,737 $28 $4,765 $1,061 $3,704 1 $4,059 $3,704 E $4,002 $3,659 Annual Data Millions of US $ except per share data 2020-08-31 2019-08-31 E EE $13,305 $1,550 $12,242 $9.444 $1,535 $11,395 Liel $1,023 $28,120 $21,807 $1,111 $23,485 $20,890 Cash On Hand Receivables Inventory Pre-Paid Expenses Other Current Assets Total Current Assets Property. Plant, And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets Total Current Liabilities Long Term Debt Other Non-Current Liabilities Total Long Term Liabilities Total Liabilities Common Stock Net I Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity Total Liabilities And Share Holders Equity EEEEEEEEEEE $2,841 $27,436 $55,556 $24,844 $7,514 $1,935 $12,007 $36,851 $4 $12,879 $-1,297 $1,025 $21,915 $45,400 $23,237 $5,124 $1,455 $6,579 $29,816 $4 $10,258 $-1,436 . EE $18,705 $55,556 $15,584 $45,400 A. Calculate the inventory-to-sale, sale-to-cash, and purchase-to-payment conversion periods for the company for year 2020. (Hint: Use "Total Current Liabilities" account balances as the value of "Account Payables", "Receivables" is the same as "Account Receivables").. Use the textbook formulas in these calculations. B. Calculate the company's Cash Conversion Cycle (CCC) for year 2020. C. Provide 3 specific operational actions that could improve the company's CCC. Explain how each suggested action could impact the CCC via the change in the inventory-to-sale, sale-to-cash, or purchase-to-payment conversion periods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts