Question: 2. Ch. 5: Measuring Inventory using FIFO, LIFO, and Average-Cost: ABC Company carries a merchandise inventory of widgets. ABC uses a periodic inventory system. On

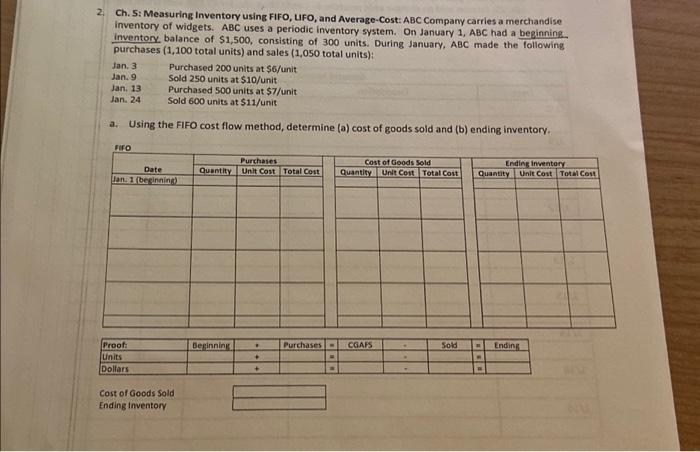

2. Ch. S: Measuring Inventory using FIFO, UFO, and Average-Cost: ABC Company carries a merchandise inventory of widgets. ABC uses a periodic inventory system. On January 1,ABC had a beginning. inventory balance of $1,500, consisting of 300 units. During January, ABC made the following purchases (1,100 total units) and sales (1,050 total units): Jan. 3 Purchased 200 units at $6/ unit Jan. 9 Sold 250 units at $10/ unit Jan. 13 Purchased 500 units at $7/ unit Jan. 24 Sold 600 units at $11/ unit a. Using the FIFO cost flow method, determine (a) cost of goods sold and (b) ending inventory. Cost of Goods Sold Ending Inventory 2. Ch. S: Measuring Inventory using FIFO, UFO, and Average-Cost: ABC Company carries a merchandise inventory of widgets. ABC uses a periodic inventory system. On January 1,ABC had a beginning. inventory balance of $1,500, consisting of 300 units. During January, ABC made the following purchases (1,100 total units) and sales (1,050 total units): Jan. 3 Purchased 200 units at $6/ unit Jan. 9 Sold 250 units at $10/ unit Jan. 13 Purchased 500 units at $7/ unit Jan. 24 Sold 600 units at $11/ unit a. Using the FIFO cost flow method, determine (a) cost of goods sold and (b) ending inventory. Cost of Goods Sold Ending Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts