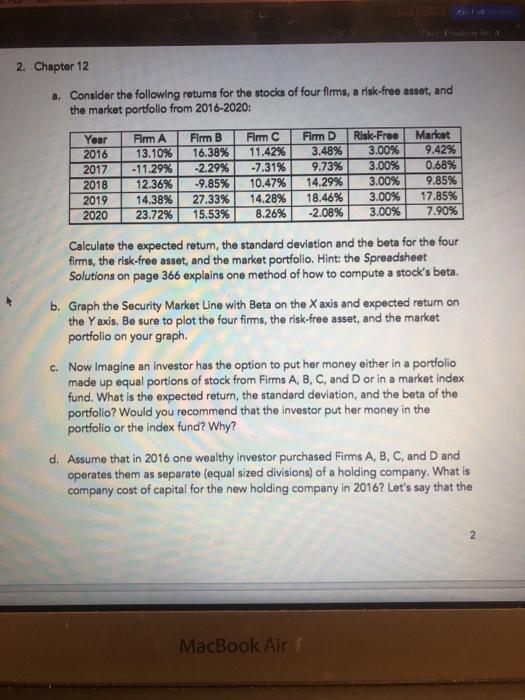

Question: 2. Chapter 12 a. Consider the following returns for the stocks of four firms, a risk-free asset, and the market portfolio from 2016-2020: Yoar 2016

2. Chapter 12 a. Consider the following returns for the stocks of four firms, a risk-free asset, and the market portfolio from 2016-2020: Yoar 2016 2017 2018 2019 2020 Firm A 13.10% - 11.29% 12.36% 14.38% 23.72% Firm B 16.38% -2.29% -9.85% 27.33% 15.53% Firm C 11.42% -7.31% 10.47% 14.28% 8.26% Fimm D 3.48% 9.73% 14.29% 18.46% -2.08% Risk-Free 3.00% 3.00% 3.00% 3.00% 3.00% Market 9.42% 0.68% 9.85% 17.85% 7.90% Calculate the expected retum, the standard deviation and the beta for the four firms, the risk-free asset, and the market portfolio. Hint: the Spreadsheet Solutions on page 366 explains one method of how to compute a stock's beta. b. Graph the Security Market Line with Beta on the X axis and expected return on the Yaxis. Be sure to plot the four firms, the risk-free asset, and the market portfolio on your graph. c. Now Imagine an investor has the option to put her money either in a portfolio made up equal portions of stock from Firms A, B, C, and D or in a market index fund. What is the expected retum, the standard deviation, and the beta of the portfolio? Would you recommend that the investor put her money in the portfolio or the index fund? Why? d. Assume that in 2016 one wealthy investor purchased Firms A, B, C, and D and operates them as separate (equal sized divisions) of a holding company. What is company cost of capital for the new holding company in 2016? Let's say that the MacBook Air Timma, otkree OC, and to marketporuolo, Fine Spreden Solutions on page 366 explains one method of how to computea stock's beta. b. Graph the Security Market Line with Beta on the X axis and expected return on the Yaxis. Be sure to plot the four firms, the risk-free asset, and the market portfolio on your graph. c. Now Imagine an investor has the option to put her money either in a portfolio made up equal portions of stock from Firms A, B, C, and D or in a market index fund. What is the expected return, the standard deviation, and the beta of the portfolio? Would you recommend that the investor put her money in the portfolio or the index fund? Why? d. Assume that in 2016 one wealthy investor purchased Firms A, B, C, and D and operates them as separate (equal sized divisions) of a holding company. What is company cost of capital for the new holding company in 2016? Let's say that the 2 holding company finds synergy from the units that were formerly housed in Firm Cand Firm D and plans to embark on a joint project between these two divisions. What is the project cost of capital? Is this the same as the company cost of capital? Why or why not? 3. Chapter 13 a. A firm has two issues of debt outstanding. One is a 9% coupon bond with a face value of $15 million, a maturity of 10 years, and a yield to maturity of 12%. The coupons are paid annually. The other bond has a maturity of 20 years, with

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts