Question: 2 Chapter 9 Differential Analysis and Product Pricing 393 380 PE 9-7A Product cost markup percentage OBJ. 2. Magna Lighting Inc. produces and sells lighting

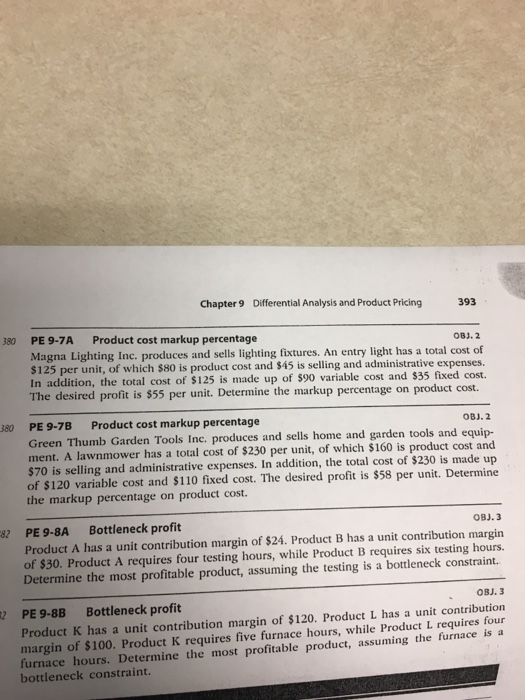

2 Chapter 9 Differential Analysis and Product Pricing 393 380 PE 9-7A Product cost markup percentage OBJ. 2. Magna Lighting Inc. produces and sells lighting fixtures. An entry light has a total cost of $125 unit, of which $80 product cost and $45 is selling and administrative expenses. addition, the total cost of s125 is made up of $90 variable cost and $35 fixed cost. The is s55 per unit. Determine the markup percentage on product cost. desired profit OBJ 2 30 PE 9-7B Product cost markup percentage tools and equip. Green Thumb Garden Tools Inc. produces and sells home and garden product cost and ment. A has a total cost of $230 per unit, of which $160 is $230 made up $7o is selling and administrative expenses. In addition, the total cost of unit. Determine of $120 variable cost and $110 fixed cost. The desired profit is $58 per the markup percentage on product cost. OBJ.3 82 PE 9-8A Bottleneck profit unit contribution margin Product A has a unit contribution margin of $24. Product B has a six testing hours. of $30. Product A requires four testing hours, while Product Brequires constraint. Determine the most profitable product, assuming the testing is a bottleneck OBJ. 3 2 PE 9-8B Bottleneck profit Product L a unit four Product K has a unit contribution margin of $120. Product L requires is a margin of $100. Product K requires five furnace hours, while furnace furnace hours. Determine the most profitable product, assuming the bottleneck constraint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts