Question: 2 Chuck, a single taxpayer, earns $ 7 5 , 0 0 0 in taxable income and $ 1 0 , 0 0 0 in

Chuck, a single taxpayer, earns $ in taxable income and $ in interest from an investment in City of Heflin bonds. Use the US tax rate scheduke

Required:

a If Chuck earns an additional $ of taxable income, what is his marginal tax rate on this income?

b What is his marginal rate if instead, he had $ of additional deductions?

Note: For all requlrements, do not round Intermedlate calculations. Round percentage answers to decimal places.

THE ANSWER IS NOT and

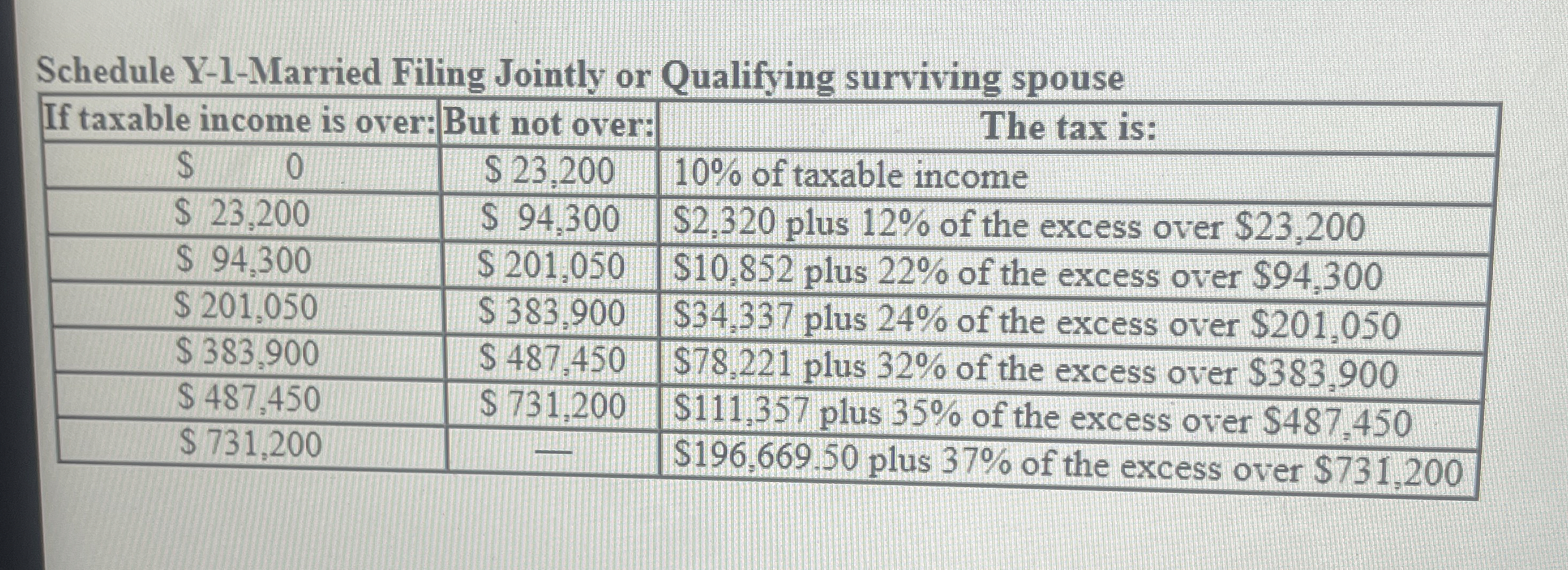

Schedule YMarried Filing Jointly or Qualifying surviving spouse

tableIf taxable income is over:,But not over:,The tax is:$$ of taxable income$$$ plus of the excess over $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock