Question: 2. Common size statement analysis (5 points) a. Prepare a common size cash flow statement using net sales as the common size and keep 2

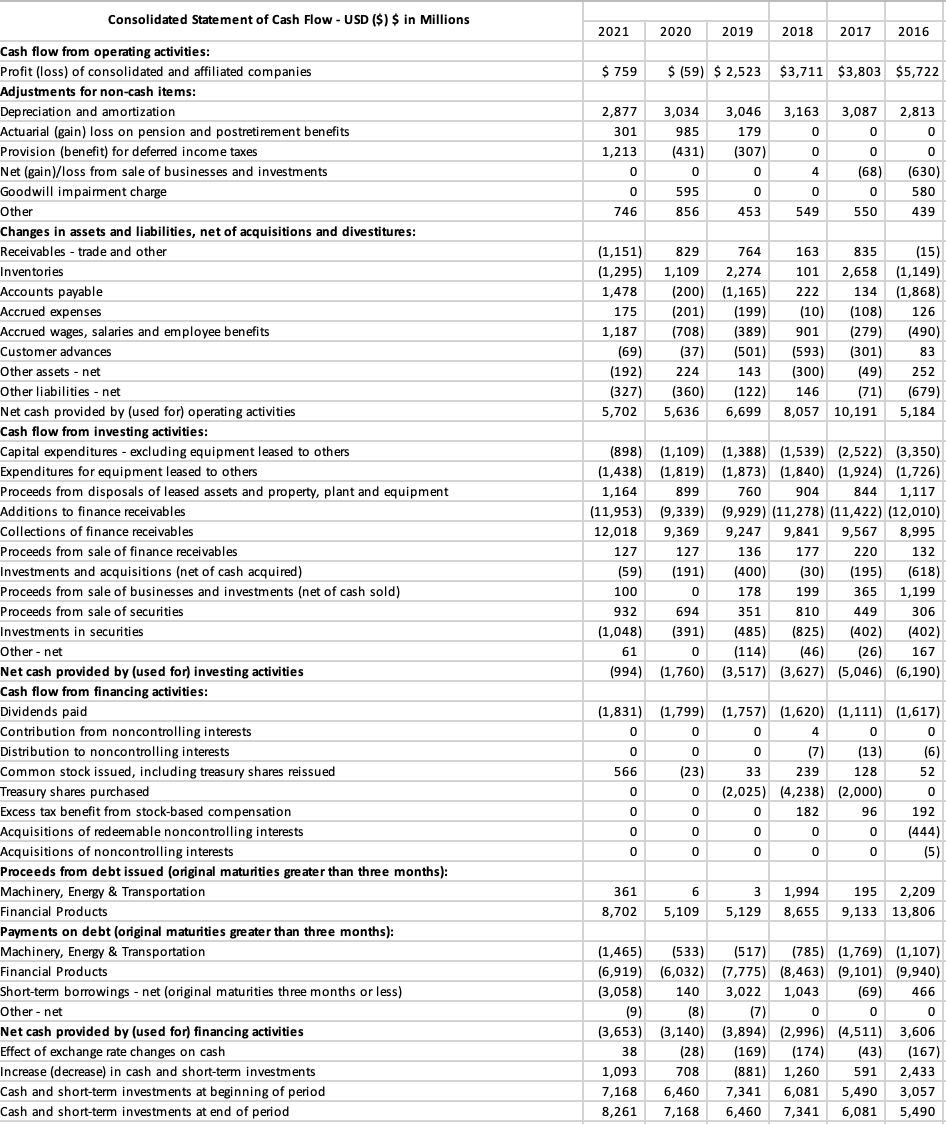

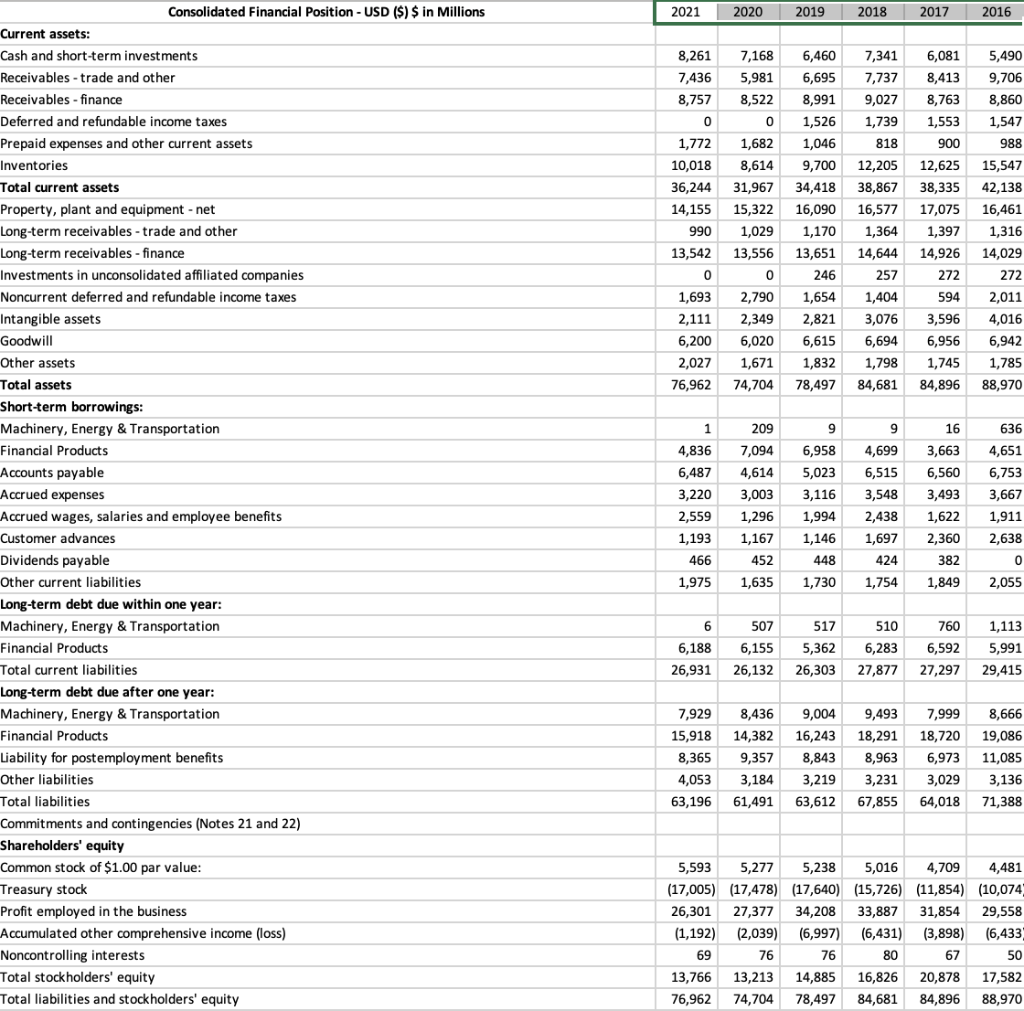

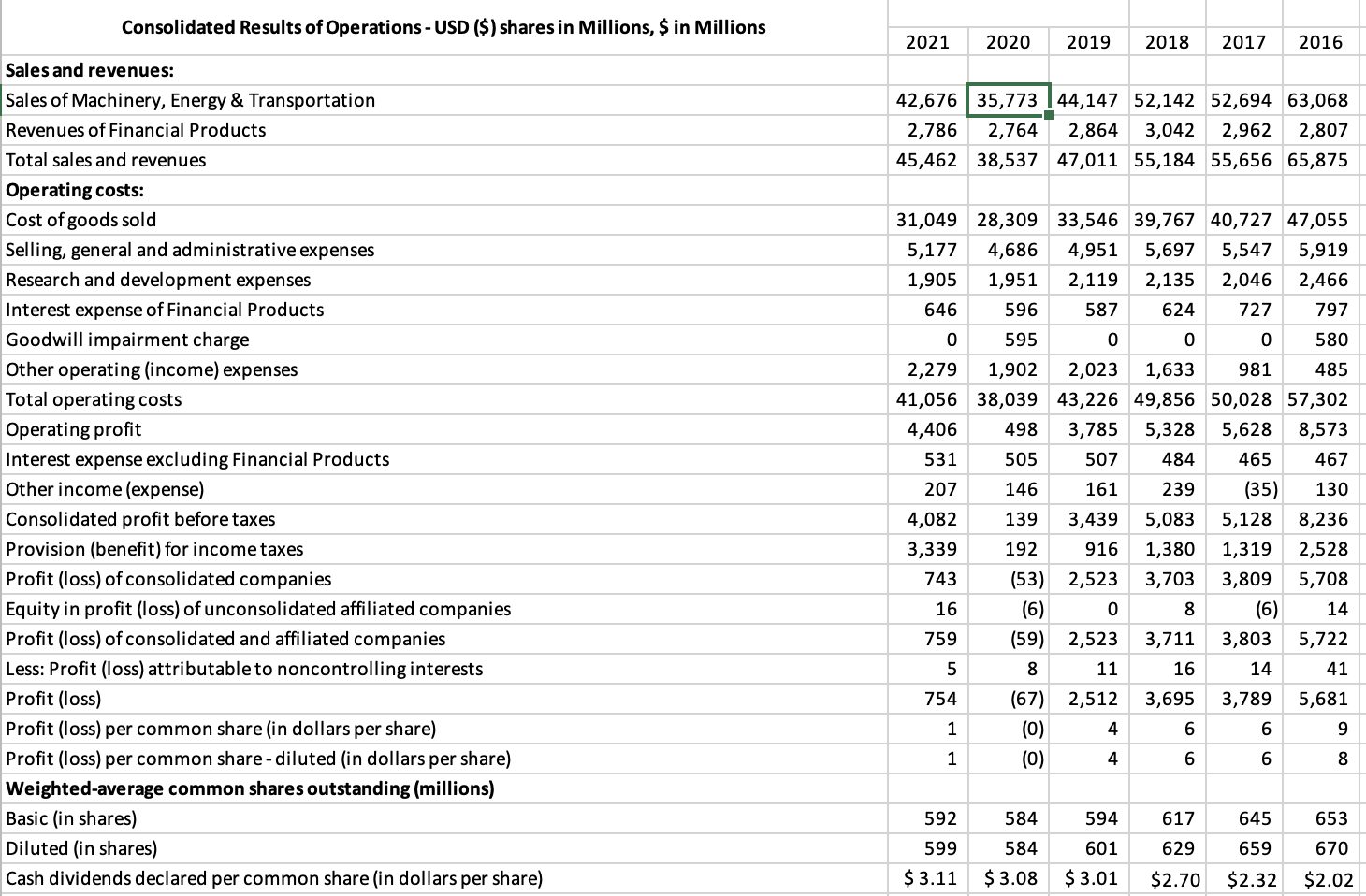

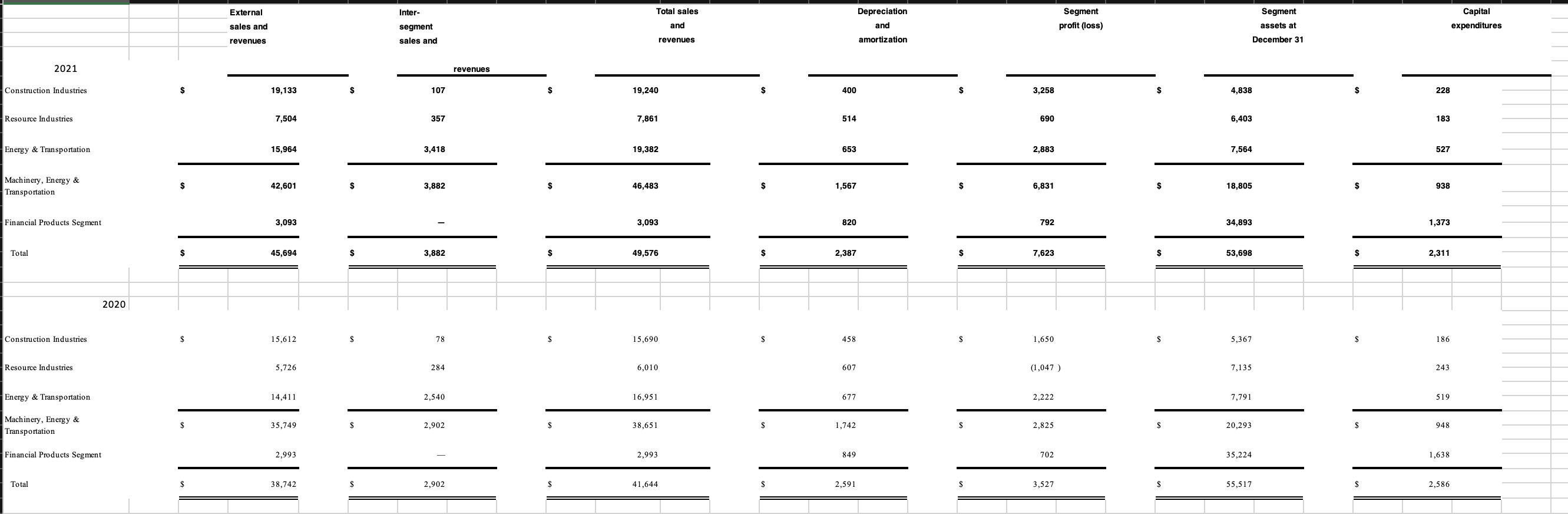

2. Common size statement analysis (5 points) a. Prepare a common size cash flow statement using net sales as the common size and keep 2 decimal places in the percentage, (for example, 12.43%). b. Are depreciation expenses and capital expenditure significant components in the cash flow statement percentagewise? Is that surprising? c. Percentage wise, is operating cash flowet sales higher than net income/sales?? Is that good? d. Do operating cash flows meet the needs of investment and distribution? Provide your comment(s) on the trend of the answer to this question?

All the charts are listed below and is this question more clearer now?

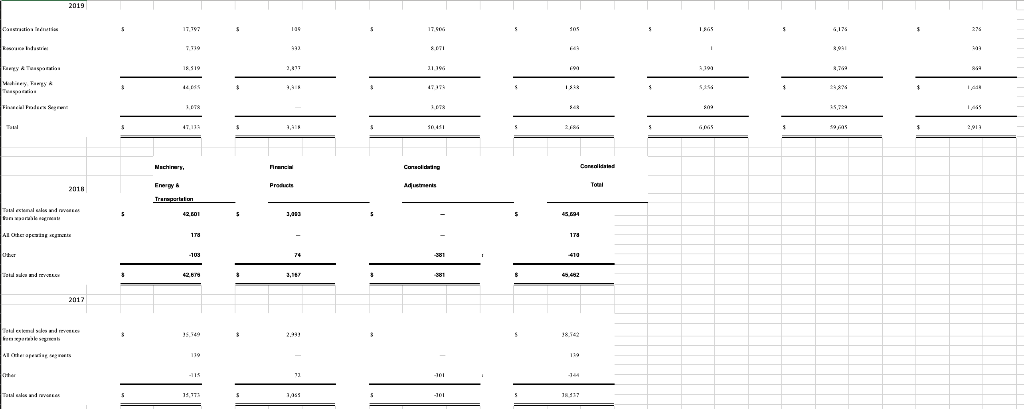

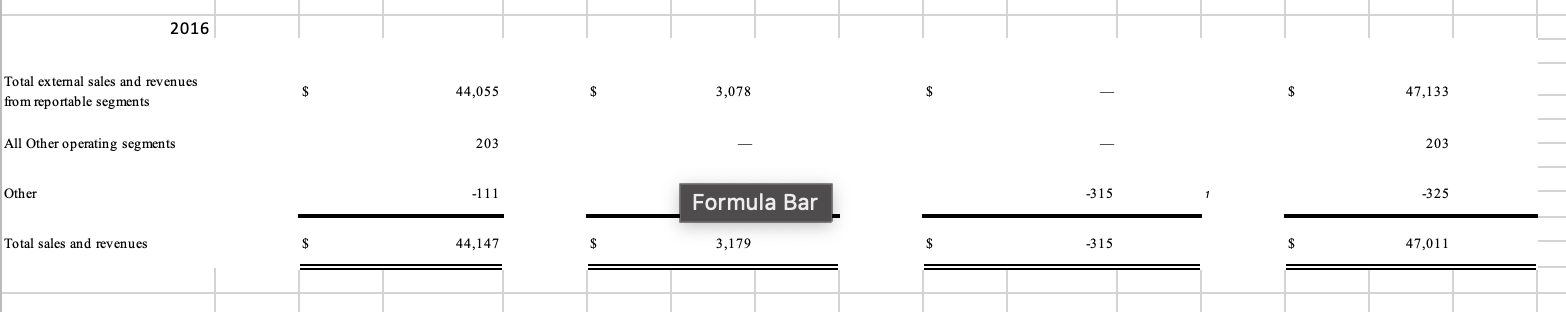

Consolidated Results of Operations - USD (\$) shares in Millions, $ in Millions Sales and revenues: Sales of Machinery, Energy \& Transportation \begin{tabular}{|r|r|r|r|r|r|} \hline 2021 & 2020 & 2019 & 2018 & 2017 & 2016 \\ \hline & & & & & \\ \hline 42,676 & 35,773 & 44,147 & 52,142 & 52,694 & 63,068 \\ \hline 2,786 & 2,764 & 2,864 & 3,042 & 2,962 & 2,807 \\ \hline 45,462 & 38,537 & 47,011 & 55,184 & 55,656 & 65,875 \\ \hline & & & & & \\ \hline 31,049 & 28,309 & 33,546 & 39,767 & 40,727 & 47,055 \\ \hline 5,177 & 4,686 & 4,951 & 5,697 & 5,547 & 5,919 \\ \hline 1,905 & 1,951 & 2,119 & 2,135 & 2,046 & 2,466 \\ \hline 646 & 596 & 587 & 624 & 727 & 797 \\ \hline 0 & 595 & 0 & 0 & 0 & 580 \\ \hline 2,279 & 1,902 & 2,023 & 1,633 & 981 & 485 \\ \hline 41,056 & 38,039 & 43,226 & 49,856 & 50,028 & 57,302 \\ \hline 4,406 & 498 & 3,785 & 5,328 & 5,628 & 8,573 \\ \hline 531 & 505 & 507 & 484 & 465 & 467 \\ \hline 207 & 146 & 161 & 239 & (35) & 130 \\ \hline 4,082 & 139 & 3,439 & 5,083 & 5,128 & 8,236 \\ \hline 3,339 & 192 & 916 & 1,380 & 1,319 & 2,528 \\ \hline 743 & (53) & 2,523 & 3,703 & 3,809 & 5,708 \\ \hline 16 & (6) & 0 & 8 & (6) & 14 \\ \hline 759 & (59) & 2,523 & 3,711 & 3,803 & 5,722 \\ \hline 5 & 8 & 11 & 16 & 14 & 41 \\ \hline 754 & (67) & 2,512 & 3,695 & 3,789 & 5,681 \\ \hline 1 & (0) & 4 & 6 & 6 & 9 \\ \hline 1 & (0) & 4 & 6 & 6 & 8 \\ \hline & & & & & \\ \hline 592 & 584 & 594 & 617 & 645 & 653 \\ \hline 599 & 584 & 601 & 629 & 659 & 670 \\ \hline 3.11 & $3.08 & $3.01 & $2.70 & $2.32 & $2.02 \\ \hline \end{tabular} Consolidated Results of Operations - USD (\$) shares in Millions, $ in Millions Sales and revenues: Sales of Machinery, Energy \& Transportation \begin{tabular}{|r|r|r|r|r|r|} \hline 2021 & 2020 & 2019 & 2018 & 2017 & 2016 \\ \hline & & & & & \\ \hline 42,676 & 35,773 & 44,147 & 52,142 & 52,694 & 63,068 \\ \hline 2,786 & 2,764 & 2,864 & 3,042 & 2,962 & 2,807 \\ \hline 45,462 & 38,537 & 47,011 & 55,184 & 55,656 & 65,875 \\ \hline & & & & & \\ \hline 31,049 & 28,309 & 33,546 & 39,767 & 40,727 & 47,055 \\ \hline 5,177 & 4,686 & 4,951 & 5,697 & 5,547 & 5,919 \\ \hline 1,905 & 1,951 & 2,119 & 2,135 & 2,046 & 2,466 \\ \hline 646 & 596 & 587 & 624 & 727 & 797 \\ \hline 0 & 595 & 0 & 0 & 0 & 580 \\ \hline 2,279 & 1,902 & 2,023 & 1,633 & 981 & 485 \\ \hline 41,056 & 38,039 & 43,226 & 49,856 & 50,028 & 57,302 \\ \hline 4,406 & 498 & 3,785 & 5,328 & 5,628 & 8,573 \\ \hline 531 & 505 & 507 & 484 & 465 & 467 \\ \hline 207 & 146 & 161 & 239 & (35) & 130 \\ \hline 4,082 & 139 & 3,439 & 5,083 & 5,128 & 8,236 \\ \hline 3,339 & 192 & 916 & 1,380 & 1,319 & 2,528 \\ \hline 743 & (53) & 2,523 & 3,703 & 3,809 & 5,708 \\ \hline 16 & (6) & 0 & 8 & (6) & 14 \\ \hline 759 & (59) & 2,523 & 3,711 & 3,803 & 5,722 \\ \hline 5 & 8 & 11 & 16 & 14 & 41 \\ \hline 754 & (67) & 2,512 & 3,695 & 3,789 & 5,681 \\ \hline 1 & (0) & 4 & 6 & 6 & 9 \\ \hline 1 & (0) & 4 & 6 & 6 & 8 \\ \hline & & & & & \\ \hline 592 & 584 & 594 & 617 & 645 & 653 \\ \hline 599 & 584 & 601 & 629 & 659 & 670 \\ \hline 3.11 & $3.08 & $3.01 & $2.70 & $2.32 & $2.02 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts