Question: 2. Company A has three projects (C, D and E) which show positive NPV. But Company does not have enough money to invest in all

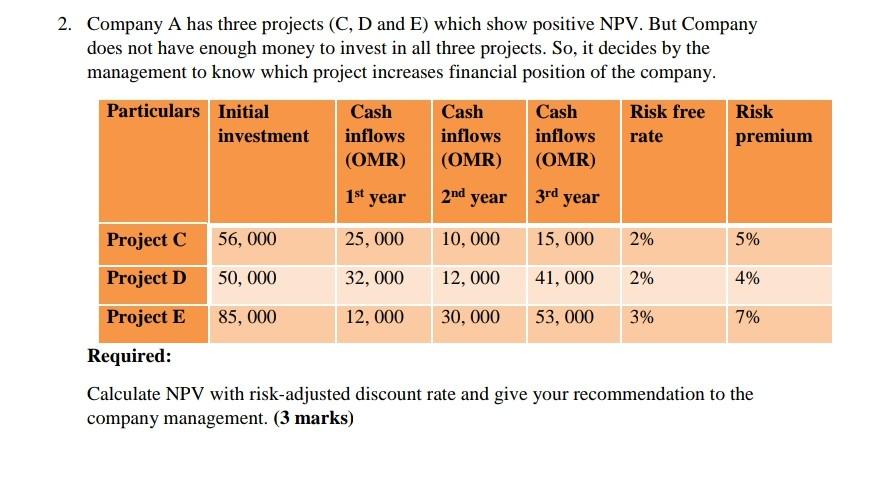

2. Company A has three projects (C, D and E) which show positive NPV. But Company does not have enough money to invest in all three projects. So, it decides by the management to know which project increases financial position of the company. Particulars Initial Cash Cash Cash Risk free Risk investment inflows inflows inflows rate premium (OMR) (OMR) (OMR) 1st year 2nd year 3rd year Project C 56, 000 25,000 10,000 15,000 2% 5% Project D 50,000 32,000 12,000 41,000 2% 4% Project E 85,000 12,000 30,000 53,000 3% 7% Required: Calculate NPV with risk-adjusted discount rate and give your recommendation to the company management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts