Question: 2. Company X is evaluating an extra dividend versus share repurchase. In either case, $14,500 would be spent. Current earnings are $1.65 per share, and

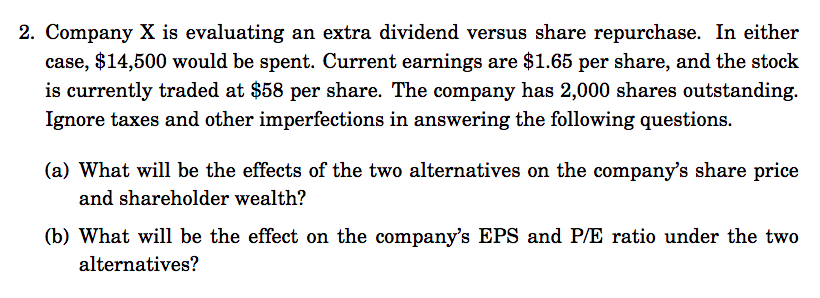

2. Company X is evaluating an extra dividend versus share repurchase. In either case, $14,500 would be spent. Current earnings are $1.65 per share, and the stock is currently traded at $58 per share. The company has 2,000 shares outstanding. Ignore taxes and other imperfections in answering the following questions. (a) What will be the effects of the two alternatives on the company's share price and shareholder wealth? (b) What will be the effect on the company's EPS and P/E ratio under the two alternatives

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock