Question: 2.) Complete the following Journal Entries Using This Form 3.) After these journal entries what is the balance of the cash account? Required Information [The

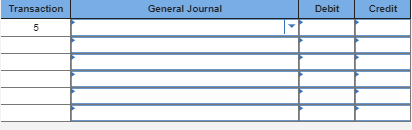

2.) Complete the following Journal Entries Using This Form

![Information [The following information applies to the questions displayed below.] The bookkeeper](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e6189cacbeb_61266e6189c5b787.jpg)

3.) After these journal entries what is the balance of the cash account?

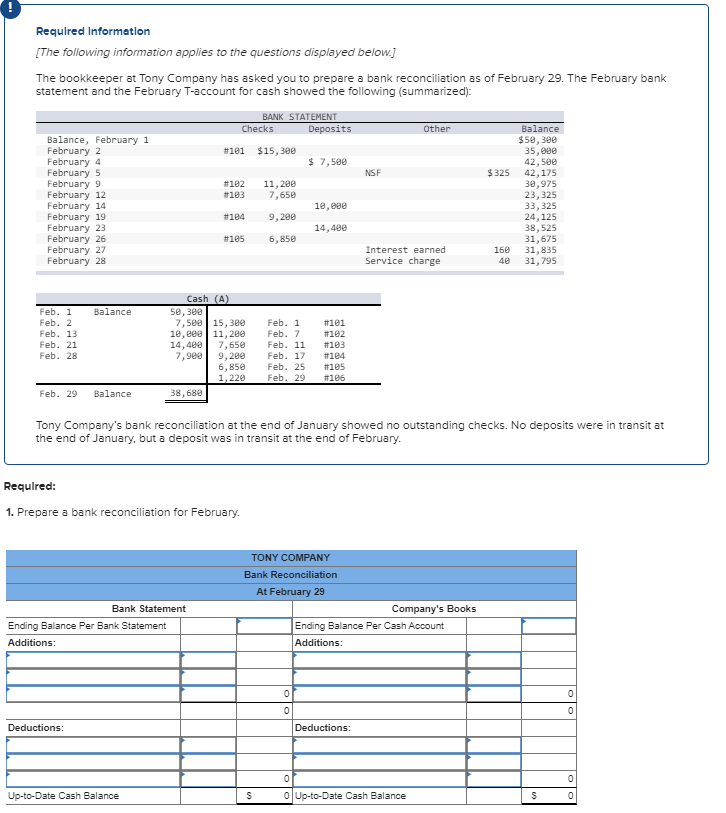

Required Information [The following information applies to the questions displayed below.] The bookkeeper at Tony Company has asked you to prepare a bank reconciliation as of February 29. The February bank statement and the February T-account for cash showed the following (summarized): BANK STATEMENT Deposits Other Checks Balance Balance, February 1 February 2 February 4 February 5 February 9 February 12 February 14 February 19 February 23 February 26 February 27 February 28 $58,30e 35,000 42,58e 42,175 30,975 23,325 33,325 24,125 38,525 31,675 31,835 31,795 #101 $15,30e 7,580 $325 NSF 11,20e 7,65e #102 #103 10,eee 9,20e #104 14,48e #105 6,85e Interest earned 16e Service charge 40 Cash (A) Feb. 1 Feb. 2 Feb. 13 Feb. 21 Balance 5e, 30e 7,5ee 15,300 10,eea 11,280 7,65e Feb. 1 #101 Feb. 7 #182 14,480 7,900 Feb. 11 # 103 Feb. 17 Feb. 28 9,200 6,85e 1,228 # 184 Feb. 25 # 105 Feb. 29 #186 Feb. 29 38,680 Balance Tony Company's bank reconciliation at the end of January showed no outstanding checks. No deposits were in transit at the end of January, but a deposit was in transit at the end of February. Required: 1. Prepare a bank reconciliation for February TONY COMPANY Bank Reconciliation At February 29 Bank Statement Company's Books Ending Balance Per Bank Statement Ending Balance Per Cash Account Additions Additions: 0 0 0 Deductions Deductions: 0 0 0Up-to-Date Cash Balance Up-to-Date Cash Balance 0 General Journal Transaction Debit Credit 5 X Record the interest of $160 received from the bank A Record the return of the customer check of $325 due to B insufficient funds C Record the service charges of $40 deducted by the bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts