Question: 2 . Compute the true expected return ( realized return ) of the portfolio that you computed in Problem 1 . Submission Guideline: Give your

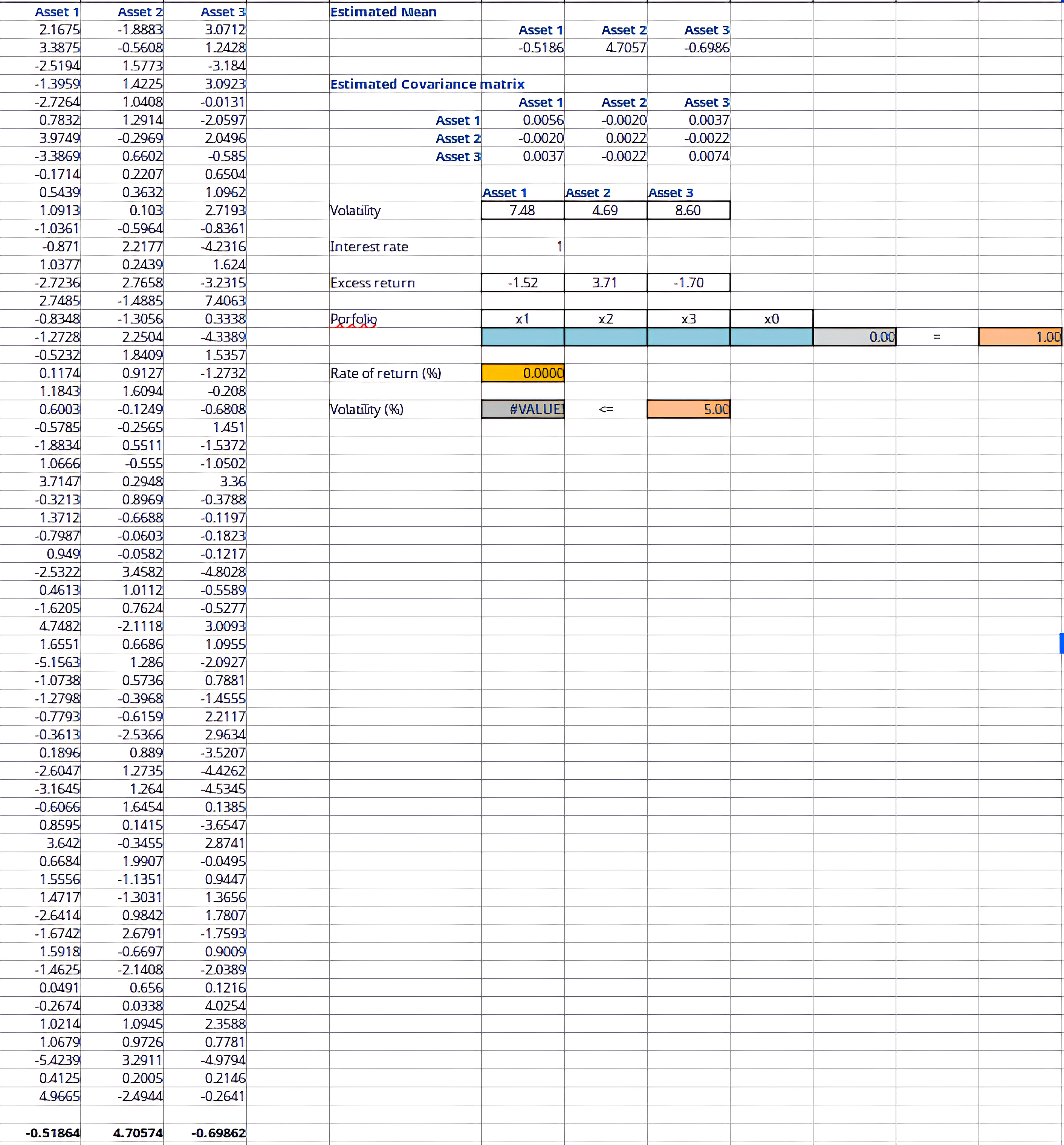

Compute the true expected return realized return of the portfolio that you computed in Problem Submission Guideline: Give your answer in rounded to decimal places. For example, if you compute the answer to be submit In the "ValueatRisk" worksheet, we list the simulated monthly returns again. From these returns, we compute the monthly rate of loss on an equally weighted portfolio of only the risky assets in column E Use this data to estimate the ValueatRisk at the probability level. The formula to compute ValueatRisk is on page of the slides for the Beyond Variance module. Submission Guideline: Give your answer in rounded to decimal places. For example, if you compute the answer to be submit In the "ValueatRisk" worksheet, we list the simulated monthly returns again. From these returns, we compute the monthly rate of loss on an equally weighted portfolio of only the risky assets in column E Use this data to estimate the Conditional ValueatRisk at the probability level. The formula to compute ValueatRisk is on page of the slides for the Beyond Variance module. Submission Guideline: Give your answer in rounded to decimal places. For example, if you compute the answer to be submit Incorrect. Strictly use this: sum of the largest NKpremember to the plus one samples divided by pN even though it might be unnatural. Consider a portfolio manager who has been successful in years out of Compute the probability of the manager having a track record as good as or better than this if he had no skill by no skill, we mean the managers have half of the chance to outperform the market, p You may assume that success or failure in any year is independent of success or failure in any other year. Submission Guideline: Give your answer to decimal places. For example, if you compute the probability to be then you should submit an answer of Suppose now there are M fund managers, each of whom have year track records. Suppose the best manager outperformed in of the years. Compute the probability that the best of the managers had a track record as good as or better than this outperform the market times out of if all of them had no skill by no skill, we mean the managers have half of the chance to outperform the market, p You may assume that success or failure in any year is independent of success or failure in any other year and that the managers' performances are independent of each other. Submission Guideline: Give your answer to decimal places. For example, if you compute the probability to be then you should submit an answer of The image I sent belongs to Assignmentxslx

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock