Question: 2. Consider a call on the same underlier (NoDiv). The strike is $53.00, which is the forward price. The owner of the call has

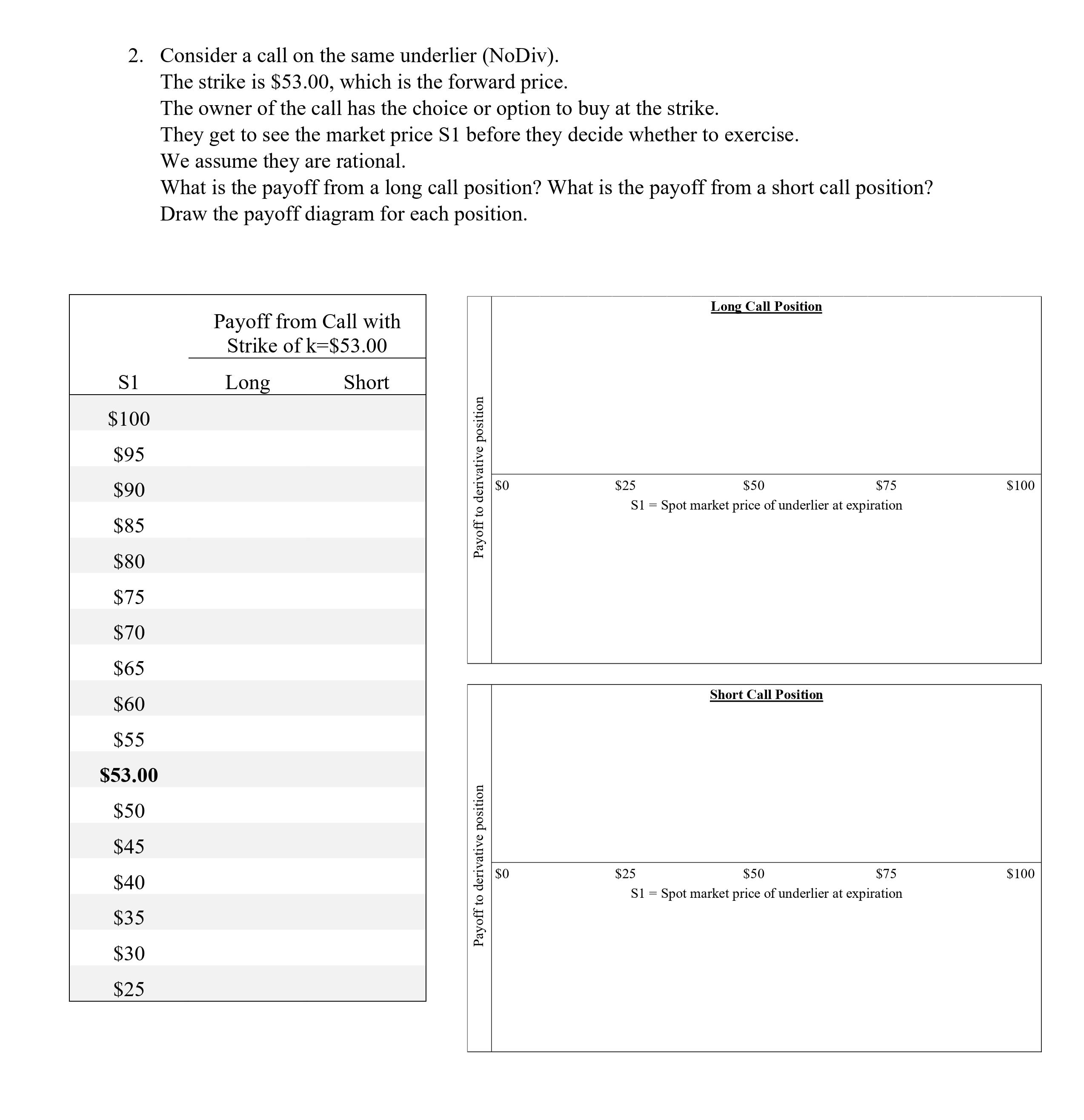

2. Consider a call on the same underlier (NoDiv). The strike is $53.00, which is the forward price. The owner of the call has the choice or option to buy at the strike. They get to see the market price S1 before they decide whether to exercise. We assume they are rational. What is the payoff from a long call position? What is the payoff from a short call position? Draw the payoff diagram for each position. Payoff from Call with Strike of k-$53.00 Short S1 Long $100 $95 $90 $85 $80 $75 $70 $65 $60 $55 $53.00 $50 $45 $40 $35 $30 $25 Payoff to derivative position Payoff to derivative position 50 $0 $25 $0 $25 Long Call Position $50 S1 = Spot market price of underlier at expiration Short Call Position $50 S1 = Spot market price of underlier at expiration $75 $100 $75 $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts