Question: 2. Consider a firm that has a project. The project, once undertaken, can produce one unit of output at no cost forever. The spot price

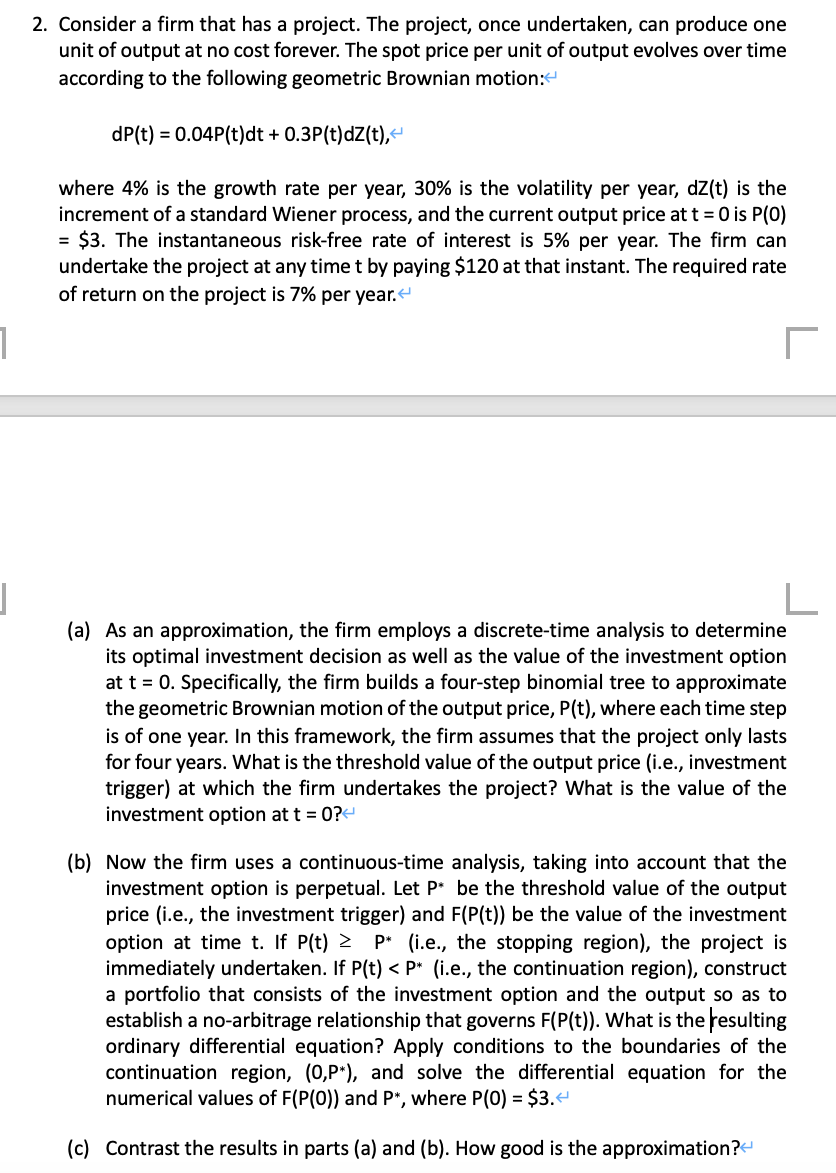

2. Consider a firm that has a project. The project, once undertaken, can produce one unit of output at no cost forever. The spot price per unit of output evolves over time according to the following geometric Brownian motion: dP(t) = 0.04P(t)dt + 0.3P(t)dz(t), where 4% is the growth rate per year, 30% is the volatility per year, dz(t) is the increment of a standard Wiener process, and the current output price at t = 0 is P(0) = $3. The instantaneous risk-free rate of interest is 5% per year. The firm can undertake the project at any time t by paying $120 at that instant. The required rate of return on the project is 7% per year.' T 1 J (a) As an approximation, the firm employs a discrete-time analysis to determine its optimal investment decision as well as the value of the investment option at t = 0. Specifically, the firm builds a four-step binomial tree to approximate the geometric Brownian motion of the output price, P(t), where each time step is of one year. In this framework, the firm assumes that the project only lasts for four years. What is the threshold value of the output price (i.e., investment trigger) at which the firm undertakes the project? What is the value of the investment option at t = 0? (b) Now the firm uses a continuous-time analysis, taking into account that the investment option is perpetual. Let P* be the threshold value of the output price (i.e., the investment trigger) and F(P(t)) be the value of the investment option at time t. If P(t) 2 P* (i.e., the stopping region), the project is immediately undertaken. If P(t)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts