Question: 2. Consider a put on a put compound option, where P has a expiry date Ti 1 and exercise price E1 = 20 and P2

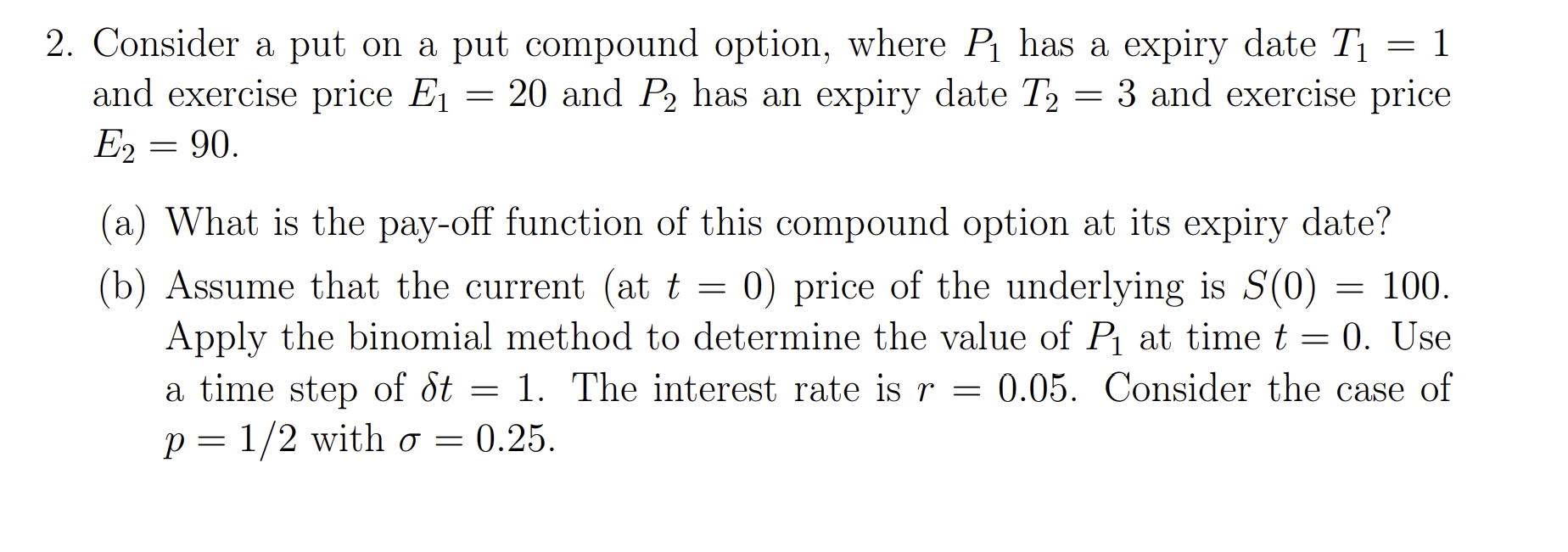

2. Consider a put on a put compound option, where P has a expiry date Ti 1 and exercise price E1 = 20 and P2 has an expiry date T2 = 3 and exercise price E2 = 90. = = = = (a) What is the pay-off function of this compound option at its expiry date? (b) Assume that the current (at t = 0) price of the underlying is S(0) 100. Apply the binomial method to determine the value of P1 at time t = 0. Use a time step of St = 1. The interest rate is r = 0.05. Consider the case of r = p= 1/2 with o = 0.25. - =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts