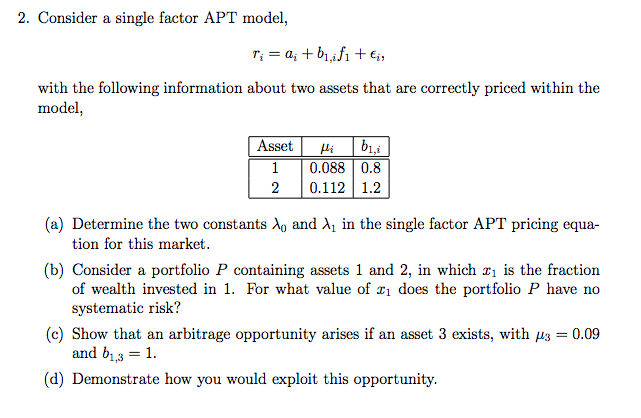

Question: 2. Consider a single factor APT model, with the following information about two assets that are correctly priced within the model, 1 0.088 0.8 20.112

2. Consider a single factor APT model, with the following information about two assets that are correctly priced within the model, 1 0.088 0.8 20.112 1.2 (a) Determine the two constants ?? and ?? in the single factor APT pricing equa- (b) Consider a portfolio P containing assets 1 and 2, in which xi is the fraction tion for this market of wealth invested in 1. For what value of x? does the portfolio P have no systematic risk? (c) Show that an arbitrage opportunity arises if an asset 3 exists, with 0.09 and b1 ,3 = 1. (d) Demonstrate how you would exploit this opportunity. 2. Consider a single factor APT model, with the following information about two assets that are correctly priced within the model, 1 0.088 0.8 20.112 1.2 (a) Determine the two constants ?? and ?? in the single factor APT pricing equa- (b) Consider a portfolio P containing assets 1 and 2, in which xi is the fraction tion for this market of wealth invested in 1. For what value of x? does the portfolio P have no systematic risk? (c) Show that an arbitrage opportunity arises if an asset 3 exists, with 0.09 and b1 ,3 = 1. (d) Demonstrate how you would exploit this opportunity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts