Question: 2. Consider a two-period (T = 2) binomial model with initial stock price So = $8, u= 2, d=1/2, and real world up probability p=1/3.

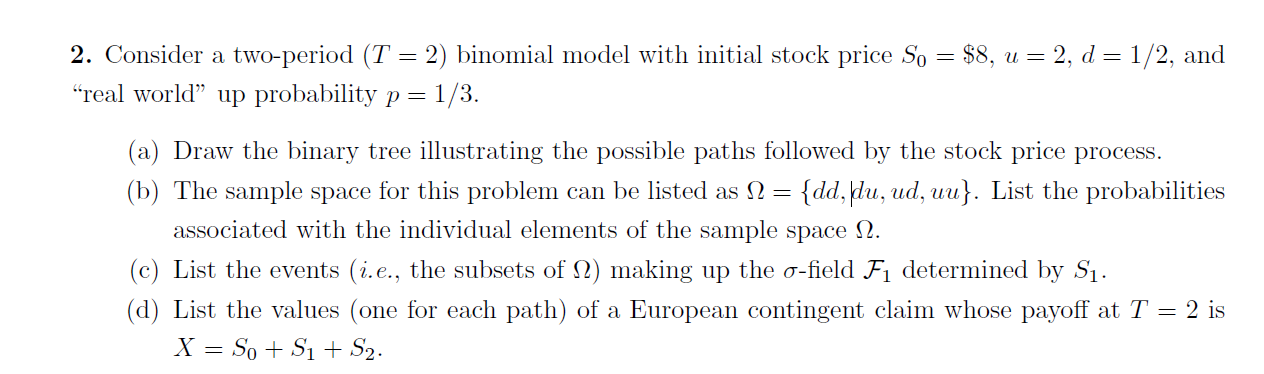

2. Consider a two-period (T = 2) binomial model with initial stock price So = $8, u= 2, d=1/2, and real world up probability p=1/3. (a) Draw the binary tree illustrating the possible paths followed by the stock price process. (b) The sample space for this problem can be listed as N = {dd, jdu, ud, uu}. List the probabilities associated with the individual elements of the sample space 12. (c) List the events (i.e., the subsets of N2) making up the o-field Fi determined by Si. (d) List the values (one for each path) of a European contingent claim whose payoff at T = 2 is X = So + S1 + S2. 2. Consider a two-period (T = 2) binomial model with initial stock price So = $8, u= 2, d=1/2, and real world up probability p=1/3. (a) Draw the binary tree illustrating the possible paths followed by the stock price process. (b) The sample space for this problem can be listed as N = {dd, jdu, ud, uu}. List the probabilities associated with the individual elements of the sample space 12. (c) List the events (i.e., the subsets of N2) making up the o-field Fi determined by Si. (d) List the values (one for each path) of a European contingent claim whose payoff at T = 2 is X = So + S1 + S2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts