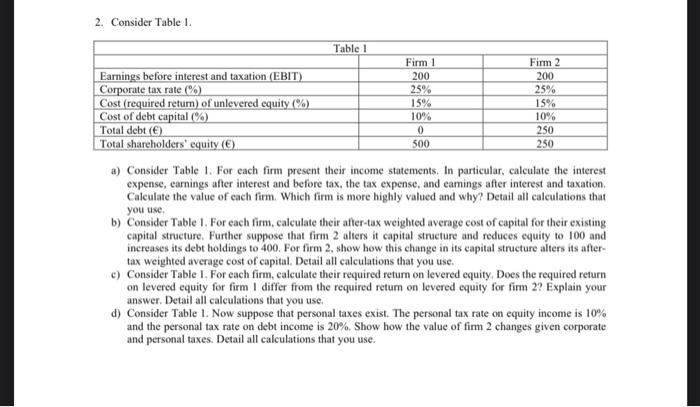

Question: 2. Consider Table 1 . a) Consider Table 1. For each firm present their income statements. In particular, calculate the interest expense, earnings after interest

2. Consider Table 1 . a) Consider Table 1. For each firm present their income statements. In particular, calculate the interest expense, earnings after interest and before tax, the tax expense, and eamings after interest and taxation. Calculate the value of each firm. Which firm is more highly valued and why? Detail all calculations that you use. b) Consider Table 1. For each firm, calculate their after-tax weighted average cost of capital for their existing capital structure. Further suppose that firm 2 alters it capital structure and reduces equity to 100 and increases its debt holdings to 400 . For firm 2, show how this change in its capital structure alters its after-tax weighted average cost of capital. Detail all calculations that you use. c) Consider Table I. For each firm, calculate their required return on levered equity, Does the required return on levered equity for firm I differ from the required return on levered equity for firm 2 ? Explain your answer. Detail all calculations that you use. d) Consider Table 1. Now suppose that personal taxes exist. The personal tax rate on equity income is 10% and the personal tax rate on debt income is 20%. Show how the value of firm 2 changes given corporate and personal taxes. Detail all calculations that you use. 2. Consider Table 1 . a) Consider Table 1. For each firm present their income statements. In particular, calculate the interest expense, earnings after interest and before tax, the tax expense, and eamings after interest and taxation. Calculate the value of each firm. Which firm is more highly valued and why? Detail all calculations that you use. b) Consider Table 1. For each firm, calculate their after-tax weighted average cost of capital for their existing capital structure. Further suppose that firm 2 alters it capital structure and reduces equity to 100 and increases its debt holdings to 400 . For firm 2, show how this change in its capital structure alters its after-tax weighted average cost of capital. Detail all calculations that you use. c) Consider Table I. For each firm, calculate their required return on levered equity, Does the required return on levered equity for firm I differ from the required return on levered equity for firm 2 ? Explain your answer. Detail all calculations that you use. d) Consider Table 1. Now suppose that personal taxes exist. The personal tax rate on equity income is 10% and the personal tax rate on debt income is 20%. Show how the value of firm 2 changes given corporate and personal taxes. Detail all calculations that you use

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts