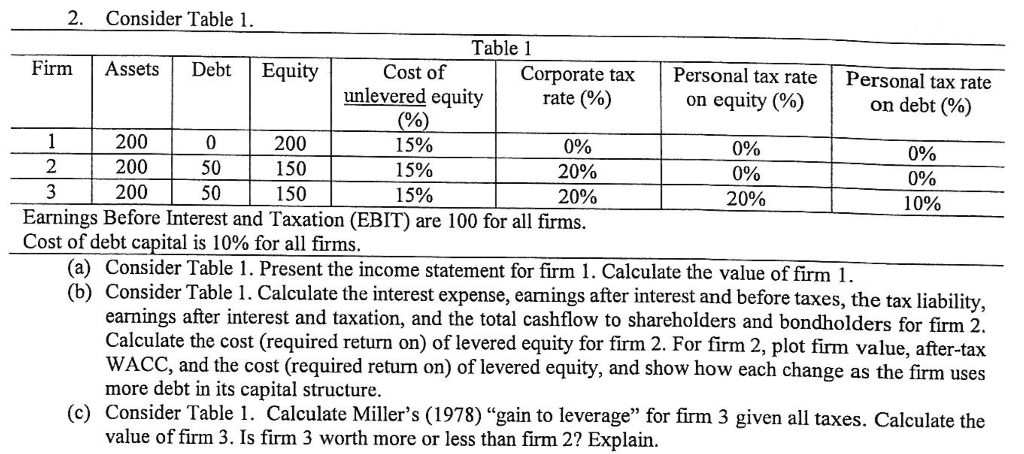

Question: 2. Consider Table 1 Table 1 Firm Assets Debt Equity Cost of rate tax Personal tax rate rate (%) Personal tax rate on debt(%) unlevered

2. Consider Table 1 Table 1 Firm Assets Debt Equity Cost of rate tax Personal tax rate rate (%) Personal tax rate on debt(%) unlevered equity | on equity (%) 200 150 200 0 15% 0% 0% 0% 200 200 2 50 15% 20% 0% 0% 50 150 15% 20% 20% 10% Earnings Before Interest and Taxation (EBIT) are 100 for all firms. Cost of debt capital is 10% for all firms (a) Consider Table 1. Present the income statement for firm 1. Calculate the value of firm 1 (b) Consider Table 1. Calculate the interest expense, earnings after interest and before taxes, the tax liability earnings after interest and taxation, and the total cashflow to shareholders and bondholders for firm 2. Calculate the cost (required return on) of levered equity for firm 2. For firm 2, plot firm value, after-tax WACC, and the cost (required return on) of levered equity, and show how each change as the firm uses more debt in its capital structure. (c) Consider Table 1. Calculate Miller's (1978) "gain to leverage" for firm 3 given all taxes. Calculate the value of firm 3. Is firm 3 worth more or less than firm 2? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts