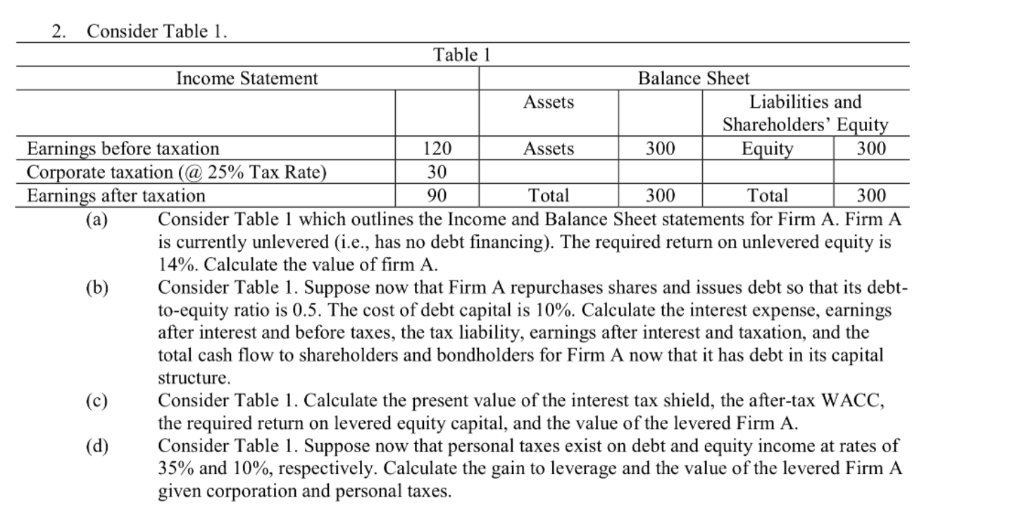

Question: 2. Consider Table 1 Table 1 Income Statement Balance Sheet Liabilities and Assets Shareholders' Equit 300 Earnings before taxation 120 Equit Assets 300 30 Corporate

2. Consider Table 1 Table 1 Income Statement Balance Sheet Liabilities and Assets Shareholders' Equit 300 Earnings before taxation 120 Equit Assets 300 30 Corporate taxation (@ 25% Tax Rate Earnings after taxation 90 Total Total 300 300 (a)Consider Table 1 which outlines the Income and Balance Sheet statements for Firm A. Firm A is currently unlevered (i.e., has no debt financing). The required return on unlevered equity is 14%. Calculate the value of firm A. (b)Consider Table 1. Suppose now that Firm A repurchases shares and issues debt so that its debt- to-equity ratio is 0.5. The cost of debt capital is 10%. Calculate the interest expense, earnings after interest and before taxes, the tax liability, earnings after interest and taxation, and the total cash flow to shareholders and bondholders for Firm A now that it has debt in its capital structure. (c)Consider Table 1. Calculate the present value of the interest tax shield, the after-tax WACC, the required return on levered equity capital, and the value of the levered Firm A (d) Consider Table 1. Suppose now that personal taxes exist on debt and equity income at rates of 35% and 10%, respectively. Calculate the gain to leverage and the value of the levered Firm A given corporation and personal taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts