Question: 2. Consider the data provided in the table below for a portfolio of assets A and B. The portfolio weights and variances are given in

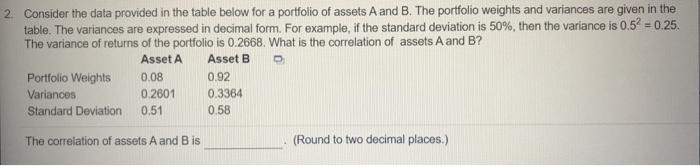

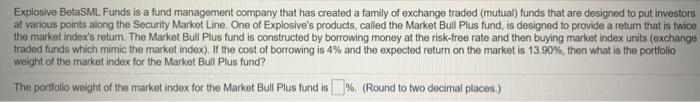

2. Consider the data provided in the table below for a portfolio of assets A and B. The portfolio weights and variances are given in the table. The variances are expressed in decimal form. For example, if the standard deviation is 50%, then the variance is 0.52 - 2 = 0.25. The variance of returns of the portfolio is 0.2668. What is the correlation of assets A and B? Asset A Asset B Portfolio Weights 0.08 0.92 Variances 0.2801 0.3384 Standard Deviation 0.51 0.58 The correlation of assets A and B is (Round to two decimal places.) Explosive BetaSML Funds is a fund management company that has created a family of exchange traded (mutual) funds that are designed to put investors at various points along the Security Market Line One of Explosive's products, called the Market Bull Plus fund, is designed to provide a return that is twice the market index's return. The Market Bull Plus fund is constructed by borrowing money at the risk-free rate and then buying market index units (exchange traded funds which mimic the market Index). If the cost of borrowing is 4% and the expected return on the market is 13.90%, then what is the portfolio weight of the market index for the Market Bull Plus fund? The portfolio weight of the market index for the Market Bull Plus fund is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts