Question: ( 2 ) Consider the extent to which state law may affect federal tax liability. ( a ) D died owning a residence that is

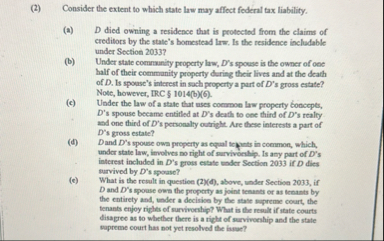

Consider the extent to which state law may affect federal tax liability.

a D died owning a residence that is protoctod from the claims of creditors by the state's homestead law. Is the residence includable under Section

b Under state community property law, Ds spouse is the owner of ooe half of their commanity property daring their lives and at the death of D Is spouse's inferest in sach property a part of Ds gross estate? Note, however, IRC b

c Under the law of a state that uses coemoe law property boncepts, s spouse became entitled at s death to one third of s realty and one third of Ds personally outright. Are these interests a part of s gross estate?

d Dand Ds spouse own preperty as equal tepunts in common, which, under state law, involves no right of surviverslip. Is any part of s interest included in Ds gross estate under Section if dies survived by Ds spocase?

e What is the result in question d above, under Section if and s upouse own the proporty as joint tesuants or as termants by the entirety and, under a decision by the state supreme court, the tenants enjoy rights of survivoship? What is the result if state courts disagree as to whether there is a right of surviveship and the state supreme court has not yet resolved the hour?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock