Question: 2. Consider the following investment strategy involving put options on a stock with the same expiration date. (1) Buy one 25-st rike put (2) Sell

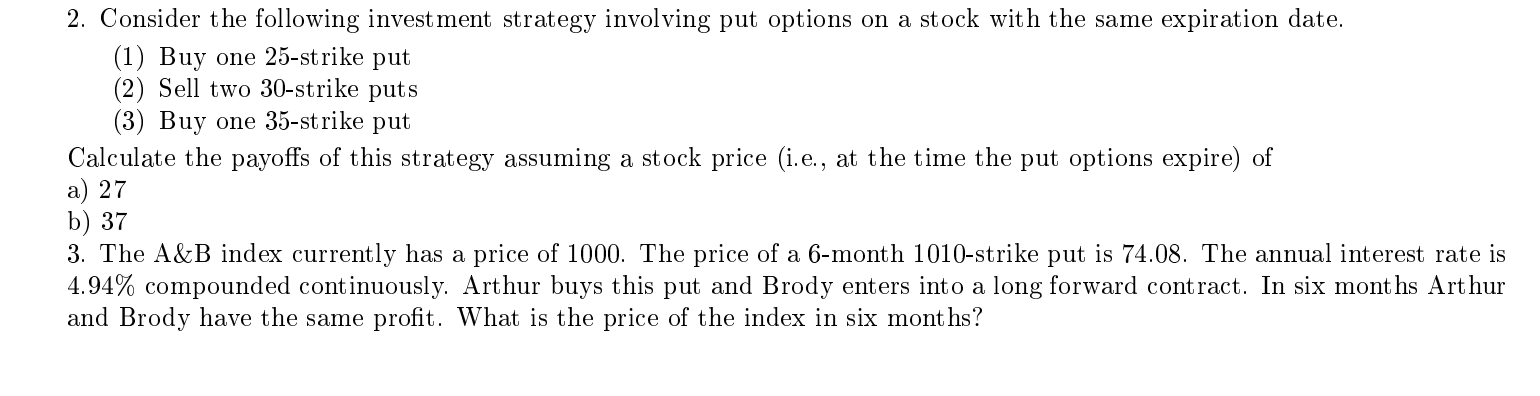

2. Consider the following investment strategy involving put options on a stock with the same expiration date. (1) Buy one 25-st rike put (2) Sell two 30-strike puts (3) Buy one 35-strike put Calculate the payoffs of this strategy assuming a stock price (i.e., at the time the put options expire) of a) 27 b) 37 3. The A&B index currently has a price of 1000. The price of a 6-month 1010-strike put is 74.08. The annual interest rate is 4.94% compounded continuously. Arthur buys this put and Brody enters into a long forward contract. In six months Arthur and Brody have the same profit. What is the price of the index in six months? 2. Consider the following investment strategy involving put options on a stock with the same expiration date. (1) Buy one 25-st rike put (2) Sell two 30-strike puts (3) Buy one 35-strike put Calculate the payoffs of this strategy assuming a stock price (i.e., at the time the put options expire) of a) 27 b) 37 3. The A&B index currently has a price of 1000. The price of a 6-month 1010-strike put is 74.08. The annual interest rate is 4.94% compounded continuously. Arthur buys this put and Brody enters into a long forward contract. In six months Arthur and Brody have the same profit. What is the price of the index in six months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts