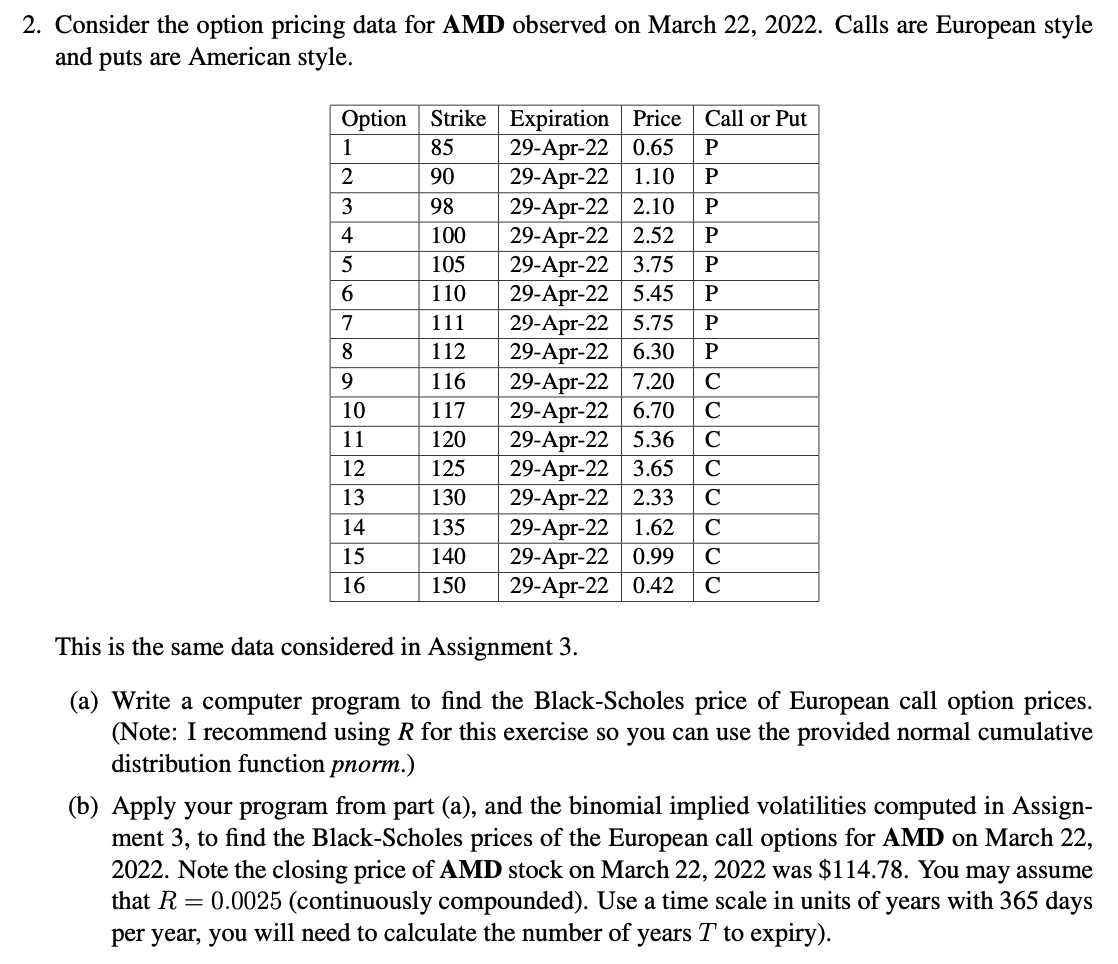

Question: 2. Consider the option pricing data for AMD observed on March 22, 2022. Calls are European style and puts are American style. Call or Put

2. Consider the option pricing data for AMD observed on March 22, 2022. Calls are European style and puts are American style. Call or Put P P P P P Option Strike Expiration Price 1 85 29-Apr-22 0.65 2 90 29-Apr-22 1.10 3 98 29-Apr-22 2.10 4 100 29-Apr-22 2.52 5 105 29-Apr-22 3.75 6 110 29-Apr-22 5.45 7 111 29-Apr-22 5.75 8 112 29-Apr-22 6.30 9 116 29-Apr-22 7.20 10 117 29-Apr-22 6.70 11 120 29-Apr-22 5.36 12 125 29-Apr-22 3.65 13 130 29-Apr-22 2.33 14 135 29-Apr-22 1.62 15 140 29-Apr-22 0.99 16 150 29-Apr-22 0.42 aaaaaaaa This is the same data considered in Assignment 3. (a) Write a computer program to find the Black-Scholes price of European call option prices. (Note: I recommend using R for this exercise so you can use the provided normal cumulative distribution function pnorm.) (b) Apply your program from part (a), and the binomial implied volatilities computed in Assign- ment 3, to find the Black-Scholes prices of the European call options for AMD on March 22, 2022. Note the closing price of AMD stock on March 22, 2022 was $114.78. You may assume that R= 0.0025 (continuously compounded). Use a time scale in units of years with 365 days per year, you will need to calculate the number of years T to expiry). 2. Consider the option pricing data for AMD observed on March 22, 2022. Calls are European style and puts are American style. Call or Put P P P P P Option Strike Expiration Price 1 85 29-Apr-22 0.65 2 90 29-Apr-22 1.10 3 98 29-Apr-22 2.10 4 100 29-Apr-22 2.52 5 105 29-Apr-22 3.75 6 110 29-Apr-22 5.45 7 111 29-Apr-22 5.75 8 112 29-Apr-22 6.30 9 116 29-Apr-22 7.20 10 117 29-Apr-22 6.70 11 120 29-Apr-22 5.36 12 125 29-Apr-22 3.65 13 130 29-Apr-22 2.33 14 135 29-Apr-22 1.62 15 140 29-Apr-22 0.99 16 150 29-Apr-22 0.42 aaaaaaaa This is the same data considered in Assignment 3. (a) Write a computer program to find the Black-Scholes price of European call option prices. (Note: I recommend using R for this exercise so you can use the provided normal cumulative distribution function pnorm.) (b) Apply your program from part (a), and the binomial implied volatilities computed in Assign- ment 3, to find the Black-Scholes prices of the European call options for AMD on March 22, 2022. Note the closing price of AMD stock on March 22, 2022 was $114.78. You may assume that R= 0.0025 (continuously compounded). Use a time scale in units of years with 365 days per year, you will need to calculate the number of years T to expiry)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts