Question: 2. Consider the simple one factor interest rate modell where the forward rate is given by f(t, T) = oWt + f(0, T) +

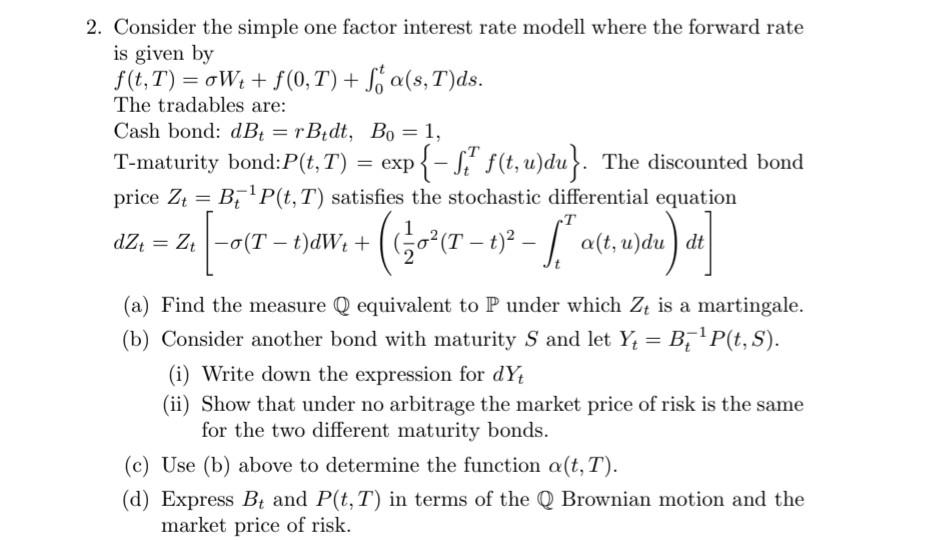

2. Consider the simple one factor interest rate modell where the forward rate is given by f(t, T) = oWt + f(0, T) + fa(s, T)ds. The tradables are: Cash bond: dBt=rBedt, Bo = 1, T-maturity bond:P(t, T) = exp{- f(t, u)du}. The discounted bond price Zt BP(t, T) satisfies the stochastic differential equation = dZtZt-o(T - t)dWt+ [-00 (/0 (T 1) - T [ a(t, u)du dt (a) Find the measure Q equivalent to P under which Z, is a martingale. (b) Consider another bond with maturity S and let Y = BP(t, S). (i) Write down the expression for dyt (ii) Show that under no arbitrage the market price of risk is the same for the two different maturity bonds. (c) Use (b) above to determine the function a(t, T). (d) Express B, and P(t, T) in terms of the Q Brownian motion and the market price of risk.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

SOLUTION a To find the equivalent measure Q under which Z is a martingale we need to determine the riskneutral drift rate which is the drift rate adju... View full answer

Get step-by-step solutions from verified subject matter experts