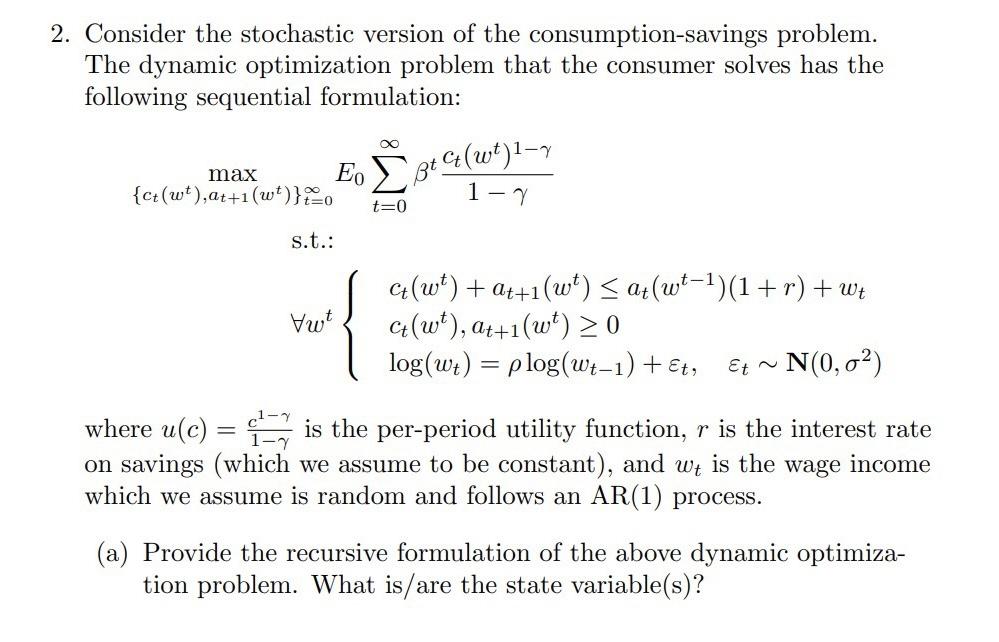

Question: 2. Consider the stochastic version of the consumption-savings problem. The dynamic optimization problem that the consumer solves has the following sequential formulation: max{ct(wt),at+1(wt)}t=0E0t=0t1ct(wt)1s.t.:wtct(wt)+at+1(wt)at(wt1)(1+r)+wtct(wt),at+1(wt)0log(wt)=log(wt1)+t,tN(0,2) where u(c)=1c1

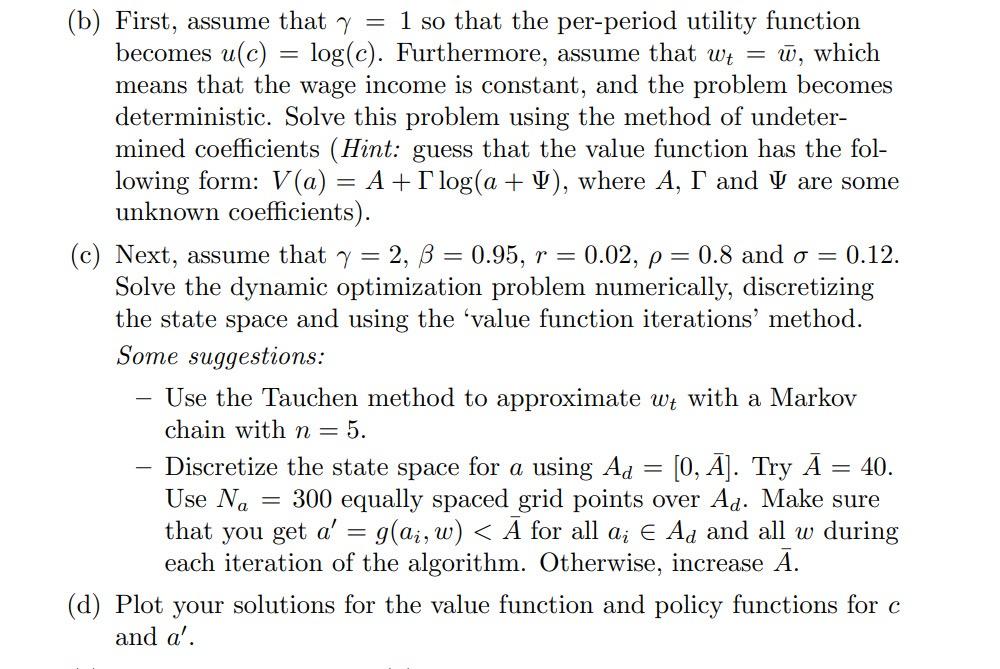

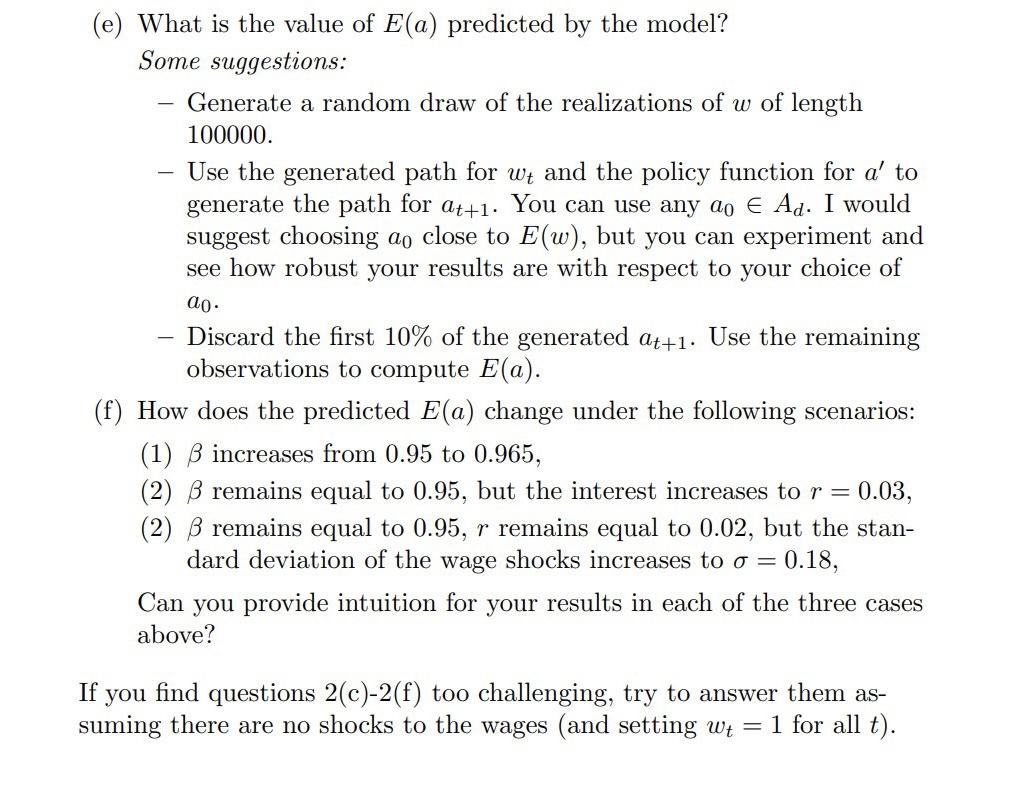

2. Consider the stochastic version of the consumption-savings problem. The dynamic optimization problem that the consumer solves has the following sequential formulation: max{ct(wt),at+1(wt)}t=0E0t=0t1ct(wt)1s.t.:wtct(wt)+at+1(wt)at(wt1)(1+r)+wtct(wt),at+1(wt)0log(wt)=log(wt1)+t,tN(0,2) where u(c)=1c1 is the per-period utility function, r is the interest rate on savings (which we assume to be constant), and wt is the wage income which we assume is random and follows an AR(1) process. (a) Provide the recursive formulation of the above dynamic optimization problem. What is/are the state variable(s)? (b) First, assume that =1 so that the per-period utility function becomes u(c)=log(c). Furthermore, assume that wt=w, which means that the wage income is constant, and the problem becomes deterministic. Solve this problem using the method of undetermined coefficients (Hint: guess that the value function has the following form: V(a)=A+log(a+), where A, and are some unknown coefficients). (c) Next, assume that =2,=0.95,r=0.02,=0.8 and =0.12. Solve the dynamic optimization problem numerically, discretizing the state space and using the 'value function iterations' method. Some suggestions: - Use the Tauchen method to approximate wt with a Markov chain with n=5. - Discretize the state space for a using Ad=[0,A]. Try A=40. Use Na=300 equally spaced grid points over Ad. Make sure that you get a=g(ai,w)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts