Question: 2. Consider two mutuallyr exclusive RSI) projects that Savage Tech is considering. Assume the discount rate for both projects is 1' percent. Project A: Server

2.

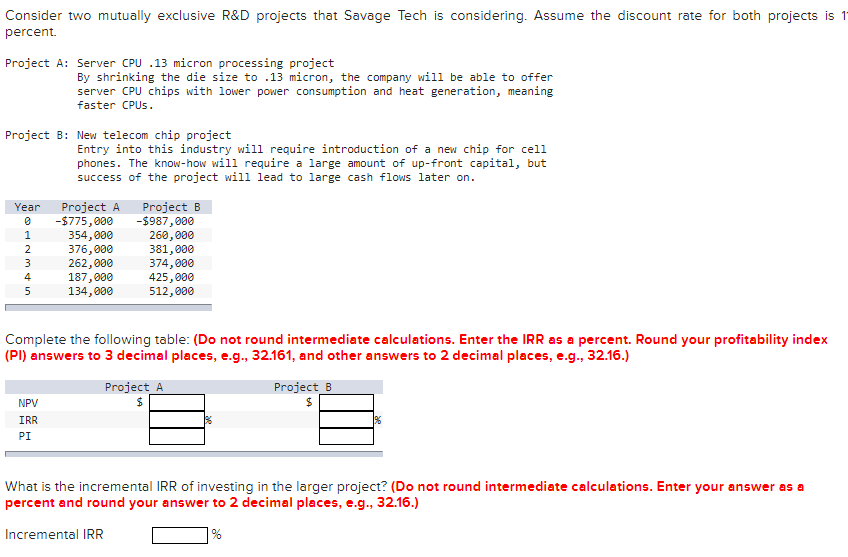

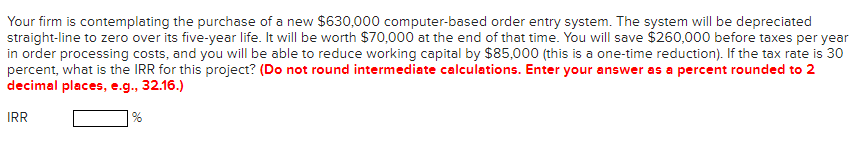

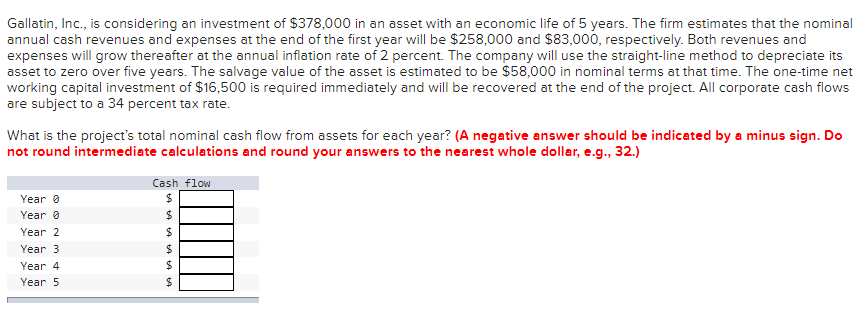

Consider two mutuallyr exclusive RSI) projects that Savage Tech is considering. Assume the discount rate for both projects is 1' percent. Project A: Server CPU .13 micron processing project By shrinking the die size to .13 micron, the company will be able to offer server CPU chips with lower power consumption and heat generation, meaning faster CPUs. Project E: New telecom chip project Entry into this industry will require introduction of a new chip For cell phones. The knowhow will require a large amount of upFront capital, but success of the project will lead to large cash flows later on. Year Project A Project B 3 $115,333 $33?,333 1 354,333 233,333 2 315,333 331,333 3 232,333 374,333 4 133,333 425,333 5 134,333 512,333 ' Complete the following table: (Do not round intermediate calculations. Enter the IRR as a percent. Round your protability index {PI} answers to 3 decimal places, e.g., 32.161, and other answers to 2 decimal places, e.g., 32.16.} Project A Project B HP'u' $- 3 lRR % PI 1What is the incremental IRR' of investing in the larger project? {Do not round intermediate calculations. Enter your answer as a percent and round your answer to 2 decimal places, e.g., 32.15.] Incremental IRR |:| 91': Your firm is contemplating the purchase of a new $630,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $70,000 at the end of that time. You will save $260,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $85,000 (this is a one-time reduction). If the tax rate is 30 percent, what is the IRR for this project? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %Gallatin, Inc, is considering an investment of $3?B,000 in an asset with an economic life of5 years. The rm estimates that the nominal annual cash revenues and expenses at the end of the first year will be $258,000 and $83,000, respectively. Both revenues and expenses will grow thereafter at the annual ination rate of 2 percent The company will use the straightline method to depreciate its asset to zero over five years. The salvage value of the asset is estimated to be $58,000 in nominal terms at that time. The one-time net working capital investment of $16,500 is required immediately and will be recovered at the end of the project. ll corporate cash ows are subject to a 34 percent tax rate. What is the project's total nominal cash ow from assets for each year? {A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole dollar, e.g., 32.] Cash Flou Year 6 3 Year 6 3 Year 2 3 Year 3 $ Year 4 3 Year 5 3