Question: 2. Continuing with the previous question, assume they replace both the muni bonds of $20 million and the low-interest mortgage loans of $50 million with

2. Continuing with the previous question, assume they replace both the muni bonds of $20 million and the low-interest mortgage loans of $50 million with higher-interest commercial loans, is the bank in compliance with both ratios?

2. Continuing with the previous question, assume they replace both the muni bonds of $20 million and the low-interest mortgage loans of $50 million with higher-interest commercial loans, is the bank in compliance with both ratios?

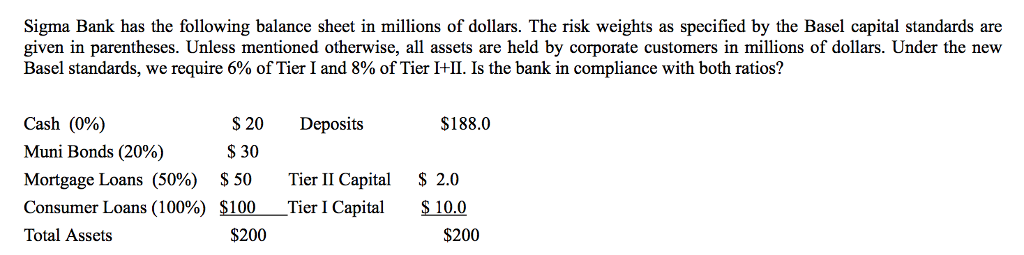

Sigma Bank has the following balance sheet in millions of dollars. The risk weights as specified by the Basel capital standards are given in parentheses. Unless mentioned otherwise, all assets are held by corporate customers in millions of dollars. Under the new Basel standards, we require 6% of Tier 1 and 8% of Tier 1+1. Is the bank in compliance with both ratios? $188.0 S 20 $ 30 $50 $100 Deposits Cash (0%) Muni Bonds (20%) Mortgage loans (50%) Consumer Loans (100%) Total Assets Tier II Capital Tier 1 Capital $2.0 $10.0 $200 $200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts