Question: 2. Corporate valuation model Aa Aa E Purple Panda Pharmaceuticals Inc.'s free cash flows (FCFS) are expected to grow at a constant long-term growth rate

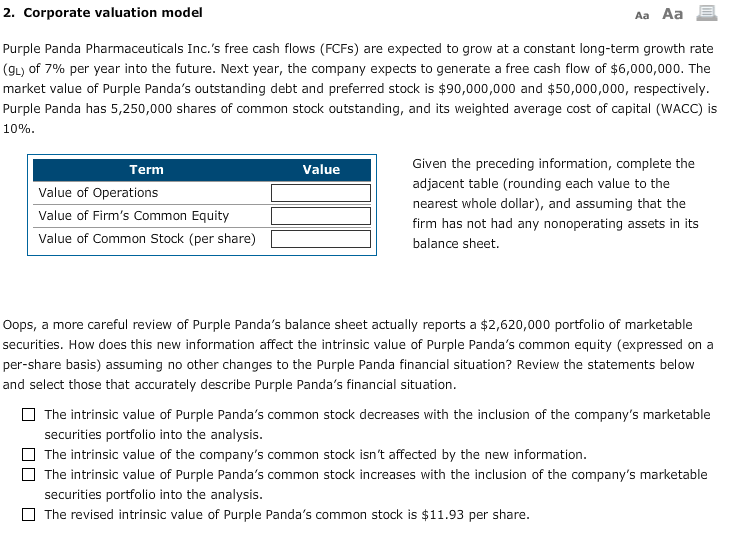

2. Corporate valuation model Aa Aa E Purple Panda Pharmaceuticals Inc.'s free cash flows (FCFS) are expected to grow at a constant long-term growth rate (9L) of 7% per year into the future. Next year, the company expects to generate a free cash flow of $6,000,000. The market value of Purple Panda's outstanding debt and preferred stock is $90,000,000 and $50,000,000, respectively. Purple Panda has 5,250,000 shares of common stock outstanding, and its weighted average cost of capital (WACC) is 10%. Value Term Value of Operations Value of Firm's Common Equity Value of Common Stock (per share) Given the preceding information, complete the adjacent table (rounding each value to the nearest whole dollar), and assuming that the firm has not had any nonoperating assets in its balance sheet. Oops, a more careful review of Purple Panda's balance sheet actually reports a $2,620,000 portfolio of marketable securities. How does this new information affect the intrinsic value of Purple Panda's common equity (expressed on a per-share basis) assuming no other changes to the Purple Panda financial situation? Review the statements below and select those that accurately describe Purple Panda's financial situation. The intrinsic value of Purple Panda's common stock decreases with the inclusion of the company's marketable securities portfolio into the analysis. The intrinsic value of the company's common stock isn't affected by the new information. The intrinsic value of Purple Panda's common stock increases with the inclusion of the company's marketable securities portfolio into the analysis. The revised intrinsic value of Purple Panda's common stock is $11.93 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts