Question: 2. Credit Risk. (40 marks) Consider a single B rated bond with a face value of $100 and a coupon rate of 5%. The bond

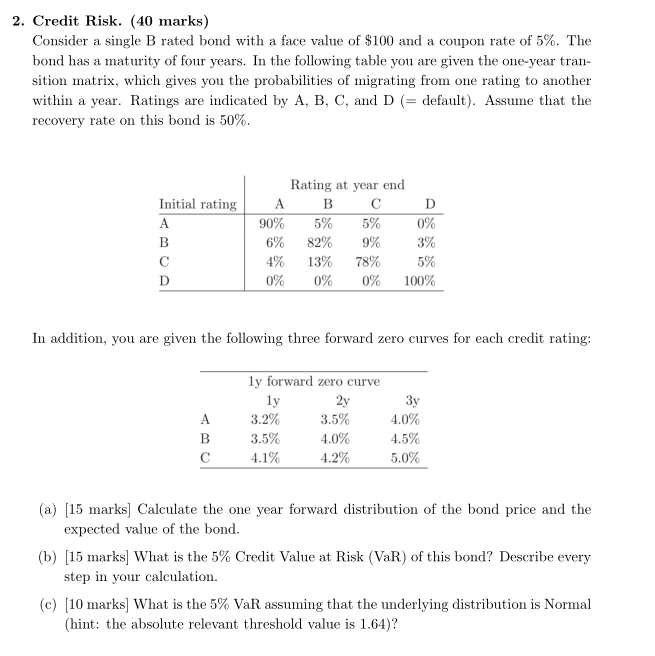

2. Credit Risk. (40 marks) Consider a single B rated bond with a face value of $100 and a coupon rate of 5%. The bond has a maturity of four years. In the following table you are given the one-year tran- sition matrix, which gives you the probabilities of migrating from one rating to another within a year. Ratings are indicated by A, B, C, and D (=default). Assume that the recovery rate on this bond is 50%. Initial rating A B D Rating at year end A B D 90% 5% 5% 0% 6% 82% 3% 4% 13% 78% 5% 0% 0% 0% 100% 9% In addition, you are given the following three forward zero curves for each credit rating: A B ly forward zero curve ly 2y 3.2% 3.5% 3.5% 4.0% 4.1% 4.2% 3y 4.0% 4.5% 5.0% (a) [15 marks] Calculate the one year forward distribution of the bond price and the expected value of the bond. (b) [15 marks] What is the 5% Credit Value at Risk (VaR) of this bond? Describe every step in your calculation. (c) (10 marks] What is the 5% VaR assuming that the underlying distribution is Normal (hint: the absolute relevant threshold value is 1.64)? 2. Credit Risk. (40 marks) Consider a single B rated bond with a face value of $100 and a coupon rate of 5%. The bond has a maturity of four years. In the following table you are given the one-year tran- sition matrix, which gives you the probabilities of migrating from one rating to another within a year. Ratings are indicated by A, B, C, and D (=default). Assume that the recovery rate on this bond is 50%. Initial rating A B D Rating at year end A B D 90% 5% 5% 0% 6% 82% 3% 4% 13% 78% 5% 0% 0% 0% 100% 9% In addition, you are given the following three forward zero curves for each credit rating: A B ly forward zero curve ly 2y 3.2% 3.5% 3.5% 4.0% 4.1% 4.2% 3y 4.0% 4.5% 5.0% (a) [15 marks] Calculate the one year forward distribution of the bond price and the expected value of the bond. (b) [15 marks] What is the 5% Credit Value at Risk (VaR) of this bond? Describe every step in your calculation. (c) (10 marks] What is the 5% VaR assuming that the underlying distribution is Normal (hint: the absolute relevant threshold value is 1.64)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts