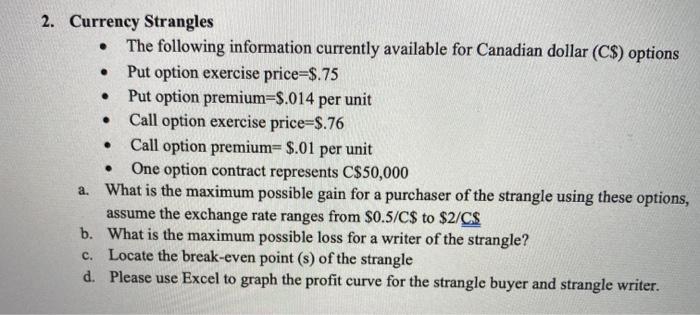

Question: . . . 2. Currency Strangles The following information currently available for Canadian dollar (C$) options Put option exercise price=$.75 Put option premium=$.014 per unit

. . . 2. Currency Strangles The following information currently available for Canadian dollar (C$) options Put option exercise price=$.75 Put option premium=$.014 per unit Call option exercise price=$.76 Call option premium= $.01 per unit One option contract represents C$50,000 a. What is the maximum possible gain for a purchaser of the strangle using these options, assume the exchange rate ranges from $0.5/C$ to $2/C$ b. What is the maximum possible loss for a writer of the strangle? c. Locate the break-even point (s) of the strangle d. Please use Excel to graph the profit curve for the strangle buyer and strangle writer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts