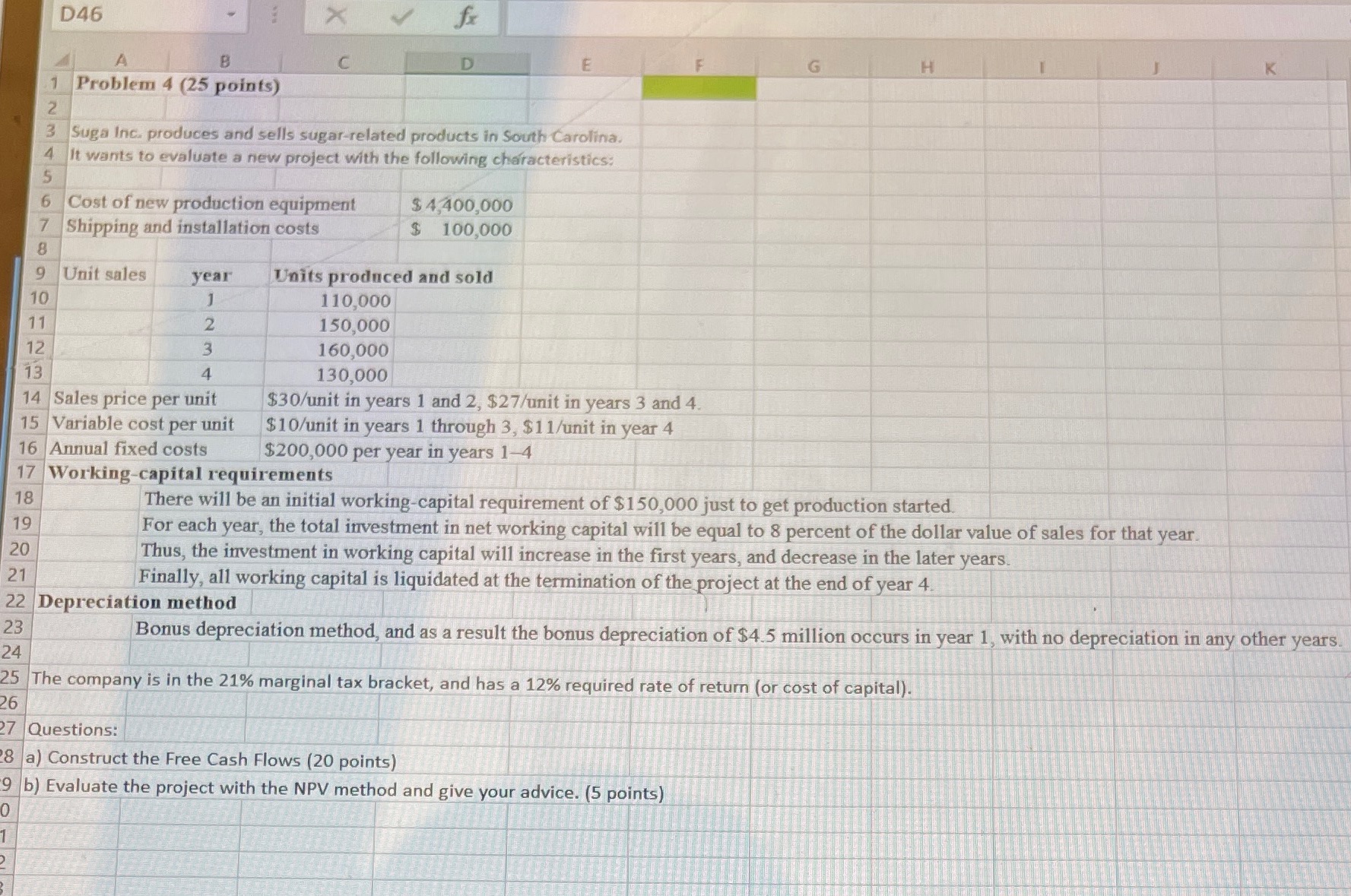

Question: 2 D46 A B 1 Problem 4 (25 points) fx C D E H 3 Suga Inc. produces and sells sugar-related products in South

2 D46 A B 1 Problem 4 (25 points) fx C D E H 3 Suga Inc. produces and sells sugar-related products in South Carolina. 4 It wants to evaluate a new project with the following characteristics: 5 6 Cost of new production equipment 7 Shipping and installation costs $4,400,000 $ 100,000 8 9 Unit sales year Units produced and sold 10 J 110,000 11 2 150,000 12 3 160,000 13 4 130,000 14 Sales price per unit 15 Variable cost per unit 16 Annual fixed costs $30/unit in years 1 and 2, $27/unit in years 3 and 4. $10/unit in years 1 through 3, $11/unit in year 4 $200,000 per year in years 1-4 17 Working-capital requirements 18 19 20 21 There will be an initial working-capital requirement of $150,000 just to get production started. For each year, the total investment in net working capital will be equal to 8 percent of the dollar value of sales for that year. Thus, the investment in working capital will increase in the first years, and decrease in the later years. Finally, all working capital is liquidated at the termination of the project at the end of year 4. 22 Depreciation method 23 24 Bonus depreciation method, and as a result the bonus depreciation of $4.5 million occurs in year 1, with no depreciation in any 25 The company is in the 21% marginal tax bracket, and has a 12% required rate of return (or cost of capital). 26 27 Questions: 28 a) Construct the Free Cash Flows (20 points) 9 b) Evaluate the project with the NPV method and give your advice. (5 points) 0 1 , other years.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts