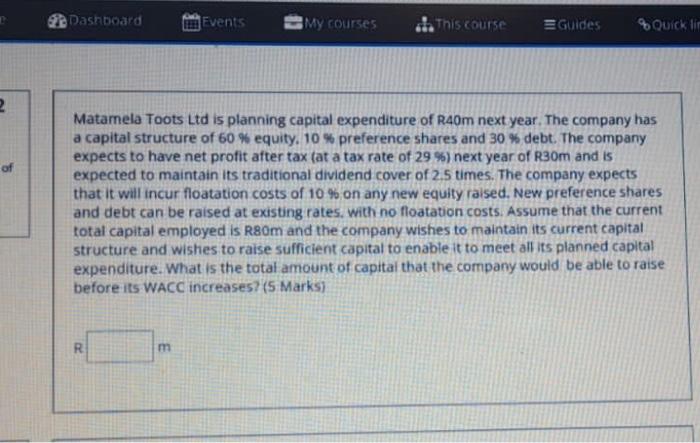

Question: 2 Dashboard Events My courses This course Guides Quick lin Matamela Toots Ltd is planning capital expenditure of R40m next year. The company has a

2 Dashboard Events My courses This course Guides Quick lin Matamela Toots Ltd is planning capital expenditure of R40m next year. The company has a capital structure of 60 % equity. 10 % preference shares and 30 % debt. The company expects to have net profit after tax (at a tax rate of 29 %) next year of R30m and is expected to maintain its traditional dividend cover of 2.5 times. The company expects that it will incur floatation costs of 10 % on any new equity raised. New preference shares and debt can be raised at existing rates, with no floatation costs. Assume that the current total capital employed is R80m and the company wishes to maintain its current capital structure and wishes to raise sufficient capital to enable it to meet all its planned capital expenditure. What is the total amount of capital that the company would be able to raise before its WACC increases? (5 Marks) m B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts