Question: 2. Delta Company is evaluating 3 projects; Alpha, Beta and Gamma as part of the 10 year strategic plan and intend to invest in only

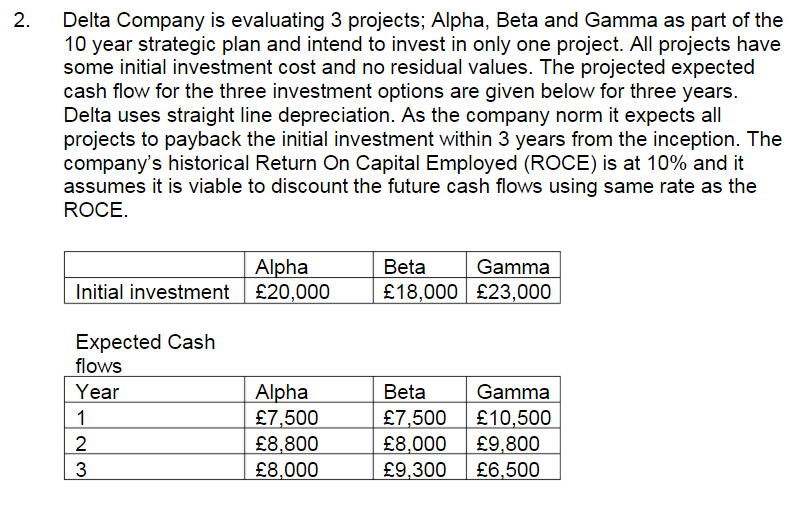

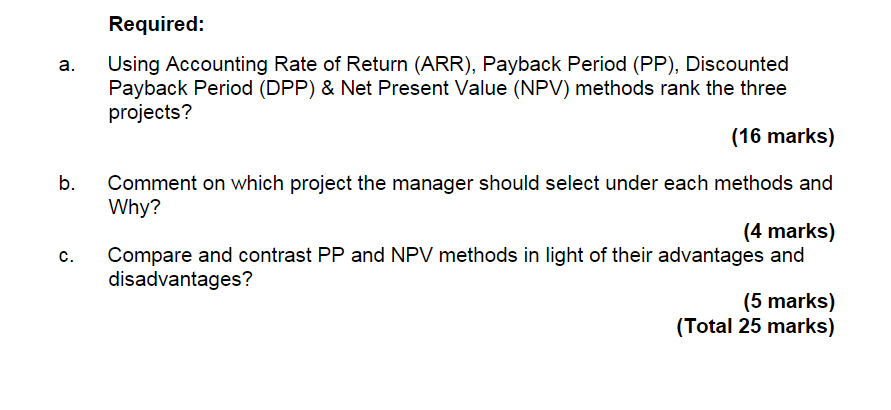

2. Delta Company is evaluating 3 projects; Alpha, Beta and Gamma as part of the 10 year strategic plan and intend to invest in only one project. All projects have some initial investment cost and no residual values. The projected expected cash flow for the three investment options are given below for three years. Delta uses straight line depreciation. As the company norm it expects all projects to payback the initial investment within 3 years from the inception. The company's historical Return On Capital Employed (ROCE) is at 10% and it assumes it is viable to discount the future cash flows using same rate as the ROCE. Alpha Initial investment 20,000 Beta Gamma 18,000 23,000 Expected Cash flows Year 1 Alpha 7,500 8,800 8,000 Beta 7,500 8,000 9,300 Gamma 10,500 9,800 6,500 WN a. Required: Using Accounting Rate of Return (ARR), Payback Period (PP), Discounted Payback Period (DPP) & Net Present Value (NPV) methods rank the three projects? (16 marks) b. c. Comment on which project the manager should select under each methods and Why? (4 marks) Compare and contrast PP and NPV methods in light of their advantages and disadvantages? (5 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts