Question: 2 Demand for nancial assets 2. Consider a modication of the example we computed in class concerning a consumer with VNM utility function deciding how

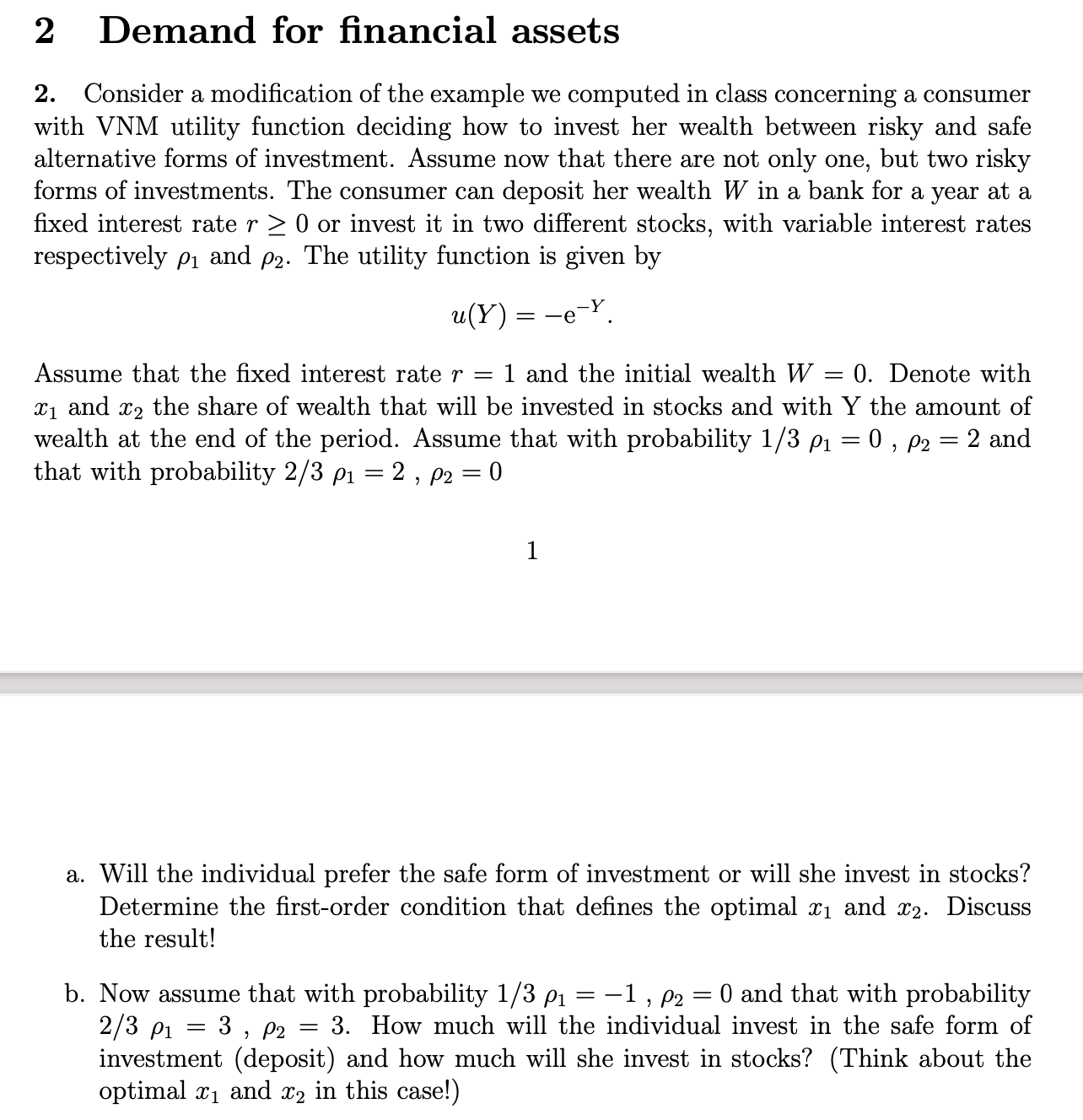

2 Demand for nancial assets 2. Consider a modication of the example we computed in class concerning a consumer with VNM utility function deciding how to invest her wealth between risky and safe alternative forms of investment. Assume now that there are not only one, but two risky forms of investments. The consumer can deposit her wealth W in a bank for a year at a fixed interest rate r 2 0 or invest it in two different stocks, with variable interest rates respectively p1 and p2. The utility function is given by Assume that the xed interest rate r = 1 and the initial wealth W = O. Denote with 1:1 and :32 the share of wealth that will be invested in stocks and with Y the amount of wealth at the end of the period. Assume that with probability 1/3 p1 = 0 , p2 = 2 and that with probability 2/3 p1 = 2 , p2 = 0 a. Will the individual prefer the safe form of investment or will she invest in stocks? Determine the rst-order condition that denes the optimal 3:1 and $2. Discuss the result! b. Now assume that with probability 1/3 p1 = l , p2 = U and that with probability 2/3 p1 = 3 , p2 = 3. How much will the individual invest in the safe form of investment (deposit) and how much will she invest in stocks? (Think about the optimal 2:1 and :52 in this case!)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts