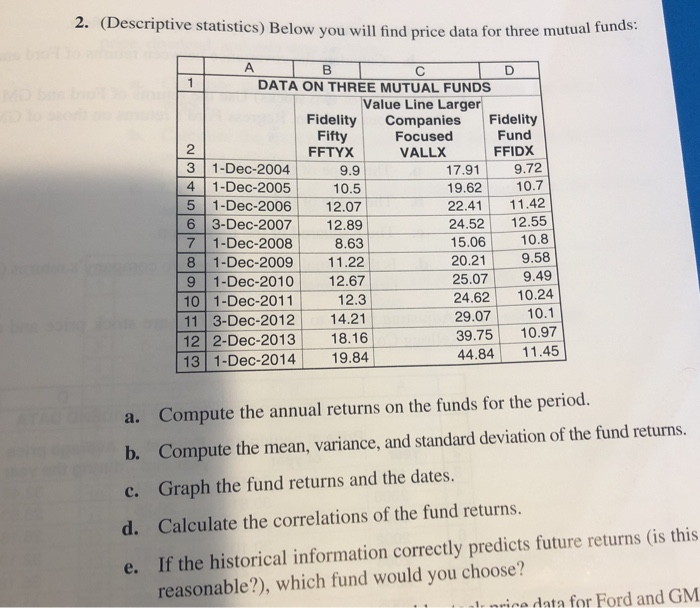

Question: 2. (Descriptive statistics) Below you will find price data for three mutual TD LA DATA ON THREE MUTUAL FUNDS Value Line Larger Fidelity Companies Fidelity

2. (Descriptive statistics) Below you will find price data for three mutual TD LA DATA ON THREE MUTUAL FUNDS Value Line Larger Fidelity Companies Fidelity Fifty Focused Fund FFTYX VALLX FFIDX | 31-Dec-2004 9.9 17.91 9.72 41-Dec-2005 10.5 19.62 10.7 51-Dec-2006 12.07 22.41 11.42 6 3-Dec-2007 12.89 24.52 12.55 71-Dec-2008 8.63 15.06 81-Dec-2009 11.22 20.21 9.58 91-Dec-2010 12.67 25.07 9.49 10 1-Dec-2011 12.3 24.62 10.24 113-Dec-2012 14.21 29.07 10.1 12 2-Dec-2013 18.16 39.75 10.97 131-Dec-2014 19.84 44.84 11.45 10.8 a. Compute the annual returns on the funds for the period. b. Compute the mean, variance, and standard deviation of the fund returns. c. Graph the fund returns and the dates. d. Calculate the correlations of the fund returns. e. If the historical information correctly predicts future returns (is this reasonable?), which fund would you choose? 11 u nrice data for Ford and GM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts