Question: 2. Determine whether Vasu can make arbitrage in the following cases and what exactly he would do to implement this Arbitrage and how much

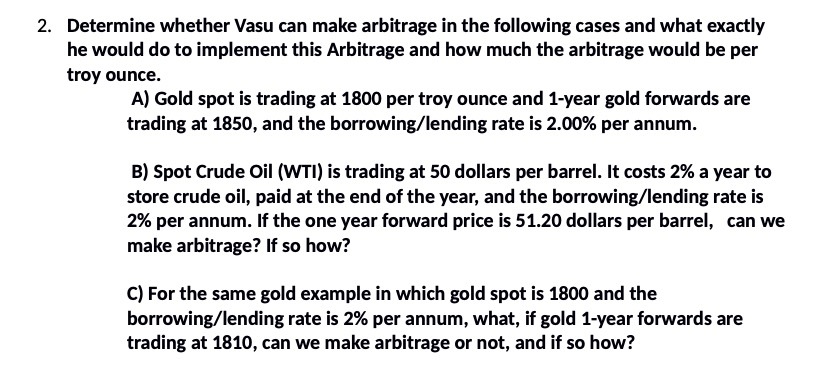

2. Determine whether Vasu can make arbitrage in the following cases and what exactly he would do to implement this Arbitrage and how much the arbitrage would be per troy ounce. A) Gold spot is trading at 1800 per troy ounce and 1-year gold forwards are trading at 1850, and the borrowing/lending rate is 2.00% per annum. B) Spot Crude Oil (WTI) is trading at 50 dollars per barrel. It costs 2% a year to store crude oil, paid at the end of the year, and the borrowing/lending rate is 2% per annum. If the one year forward price is 51.20 dollars per barrel, can we make arbitrage? If so how? C) For the same gold example in which gold spot is 1800 and the borrowing/lending rate is 2% per annum, what, if gold 1-year forwards are trading at 1810, can we make arbitrage or not, and if so how?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts