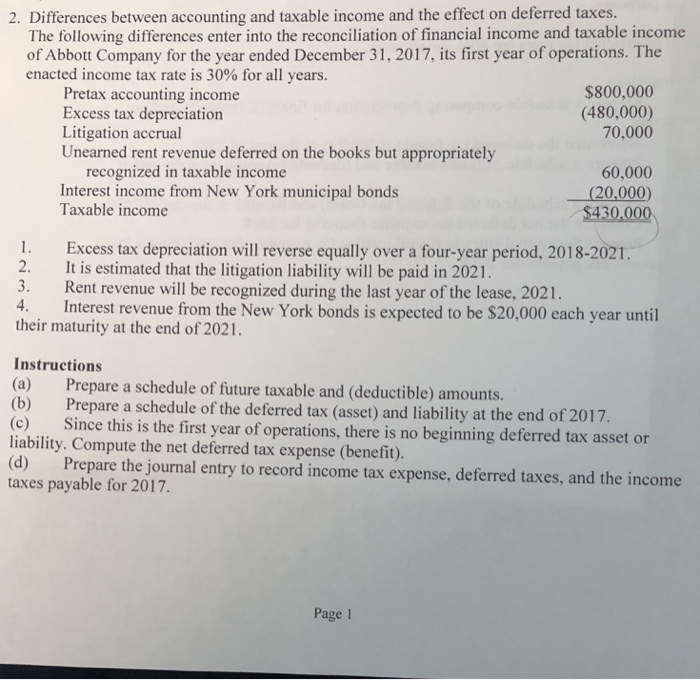

Question: 2. Differences between accounting and taxable income and the effect on deferred taxes. The following differences enter into the reconciliation of financial income and taxable

2. Differences between accounting and taxable income and the effect on deferred taxes. The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended December 31, 2017, its first year of operations. The $800,000 (480,000) 70,000 Pretax accounting income Excess tax depreciation Litigation accrual Unearned rent revenue deferred on the books but appropriately 60,000 (20,000) $430,000 recognized in taxable income Interest income from New York municipal bonds Taxable income 1. Excess tax depreciation will reverse equally over a four-year period, 2018-2021. 2. It is estimated that the litigation liability will be paid in 2021 3. Rent revenue will be recognized during the last year of the lease, 2021 4. Interest revenue from the New York bonds is expected to be $20,000 each year until their maturity at the end of 2021. Instructions (a) Prepare a schedule of future taxable and (deductible) amounts. (b) Prepare a schedule of the deferred tax (asset) and liability at the end of 201 (c) Since this is the first year of operations, there is no beginning deferred tax asset or liability. Compute the net deferred tax expense (benefit). (d) Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2017. Page 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts