Question: 2 different pictures look at both please. Lifo method A company made the following merchandise purchases and sales during the month of June: 1-Jun 6-Jun

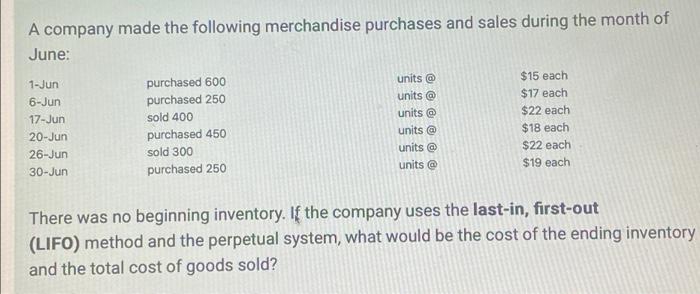

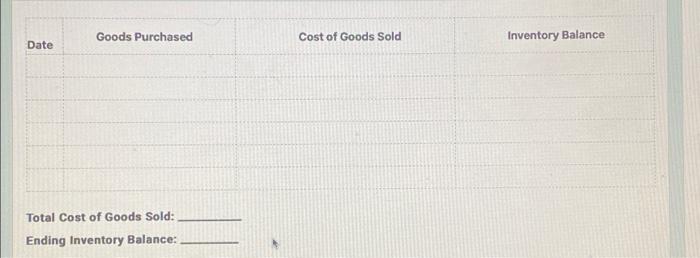

A company made the following merchandise purchases and sales during the month of June: 1-Jun 6-Jun 17-Jun 20-Jun 26-Jun 30-Jun purchased 600 purchased 250 sold 400 purchased 450 sold 300 purchased 250 units @ units @ units @ units @ units @ units @ $15 each $17 each $22 each $18 each $22 each $19 each There was no beginning inventory. If the company uses the last-in, first-out (LIFO) method and the perpetual system, what would be the cost of the ending inventory and the total cost of goods sold? Goods Purchased Cost of Goods Sold Date Inventory Balance Total Cost of Goods Sold: Ending Inventory Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts