Question: 2. Do the following present value problems. You must set up all present value problems before calculation. Merely writing down the answer (even if it

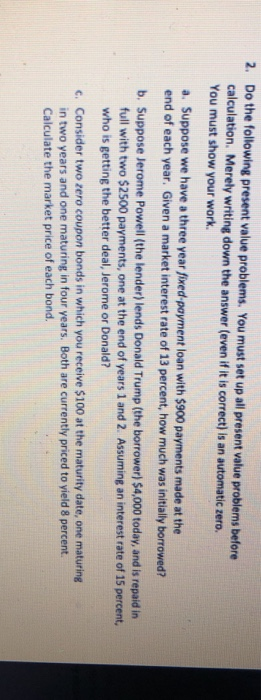

2. Do the following present value problems. You must set up all present value problems before calculation. Merely writing down the answer (even if it is correct) is an automatic zero. You must show your work. a. Suppose we have a three year fixed payment loan with $900 payments made at the end of each year. Given a market interest rate of 13 percent, how much was initially borrowed? b. Suppose Jerome Powell (the lender) lends Donald Trump (the borrower) $4,000 today, and is repaid in full with two $2500 payments, one at the end of years 1 and 2. Assuming an interest rate of 15 percent who is getting the better deal, Jerome or Donald? C. Consider two zero coupon bonds in which you receive $100 at the maturity date, one maturing in two years and one maturing in four years. Both are currently priced to yield 8 percent Calculate the market price of each bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts