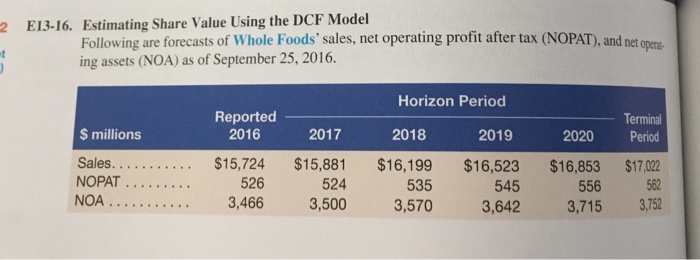

Question: 2 E13-16. Estimating Share Value Using the DCF Model Following are forecasts of Whole Foods' sales, net operating profit after tax (NOPAT) and net ing

2 E13-16. Estimating Share Value Using the DCF Model Following are forecasts of Whole Foods' sales, net operating profit after tax (NOPAT) and net ing assets (NOA) as of September 25, 2016. er Horizon Period Reported 2016 Termina 2020 Period $ millions 2017 2018 2019 524 3,466 3,500 3,570 526 556 562 3,642 3,715 3,752 535 545 2 E13-16. Estimating Share Value Using the DCF Model Following are forecasts of Whole Foods' sales, net operating profit after tax (NOPAT) and net ing assets (NOA) as of September 25, 2016. er Horizon Period Reported 2016 Termina 2020 Period $ millions 2017 2018 2019 524 3,466 3,500 3,570 526 556 562 3,642 3,715 3,752 535 545

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts