Question: 2. Estimate a multiple linear regression relationship with the U.K. stock returns as the dependent variable (RSUK), and U.K. T-Bill Returns (RUK), U.S. Stock Returns

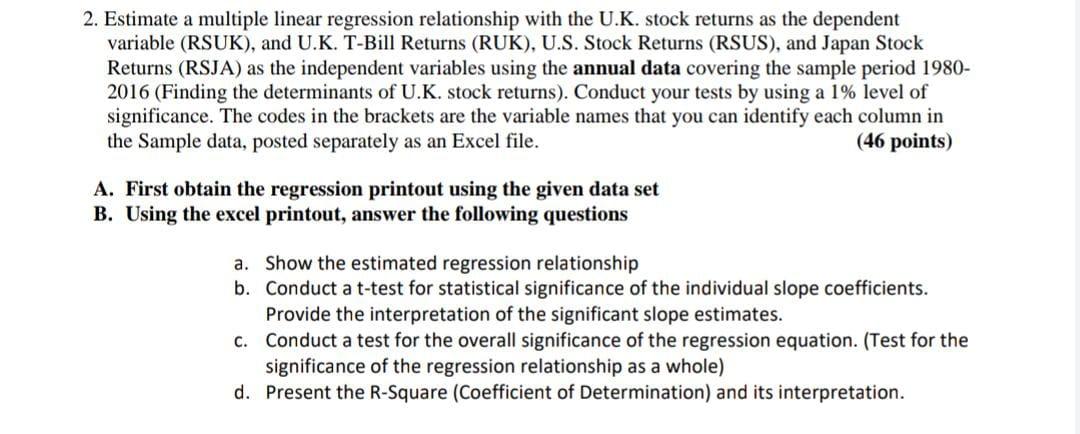

2. Estimate a multiple linear regression relationship with the U.K. stock returns as the dependent variable (RSUK), and U.K. T-Bill Returns (RUK), U.S. Stock Returns (RSUS), and Japan Stock Returns (RSJA) as the independent variables using the annual data covering the sample period 19802016 (Finding the determinants of U.K. stock returns). Conduct your tests by using a 1\% level of significance. The codes in the brackets are the variable names that you can identify each column in the Sample data, posted separately as an Excel file. (46 points) A. First obtain the regression printout using the given data set B. Using the excel printout, answer the following questions a. Show the estimated regression relationship b. Conduct a t-test for statistical significance of the individual slope coefficients. Provide the interpretation of the significant slope estimates. c. Conduct a test for the overall significance of the regression equation. (Test for the significance of the regression relationship as a whole) d. Present the R-Square (Coefficient of Determination) and its interpretation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts