Question: 2. Evaluating debt burden. Isaac Wright has a monthly take home pay of 51.685: he makes payments of $410 a month on his outstanding consumer

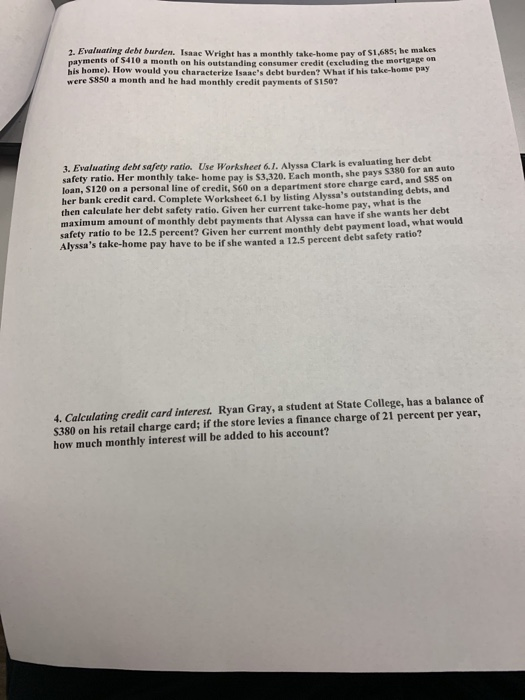

2. Evaluating debt burden. Isaac Wright has a monthly take home pay of 51.685: he makes payments of $410 a month on his outstanding consumer credit (excluding the mortgage or his home). How would you characterize Isane's debt burden? What if his take-home pay were $850 a month and he had monthly credit payments of $1502 3. Evaluating debr safety rario, Use Worksheet 61. Alyssa Clark is evaluating her debt safety ratio. Her monthly take-home pay is $3.320. Each month, she pays $380 for an auto loan, S120 on a personal line of credit, S60 on a department store charge card, and is on her bank credit card. Complete Worksheet 61 by listing Alyssa's outstanding debts, and then calculate her debt safety ratio. Given her current take-home pay, what is the maximum amount of monthly debt mayments that Alyssa can have if she wants her debt safety ratio to be 12.5 percent? Given her current monthly debt payment load, what would Alyssa's take-home pay have to be if she wanted a 12.5 percent debt safety ratio? 4. Calculating credit card interest. Ryan Gray, a student at State College, has a balance of 5380 on his retail charge card; if the store levies a finance charge of 21 percent per year, how much monthly interest will be added to his account

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts