Question: 2. Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000. a. Calculate the price of the bond for

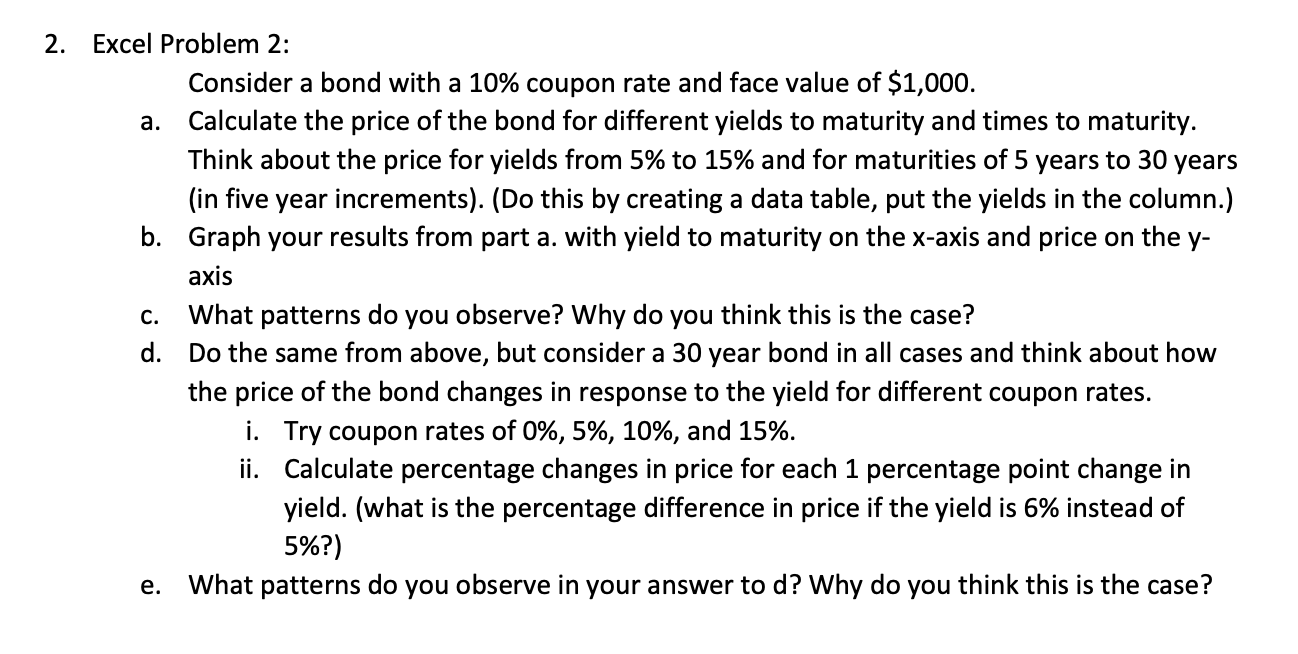

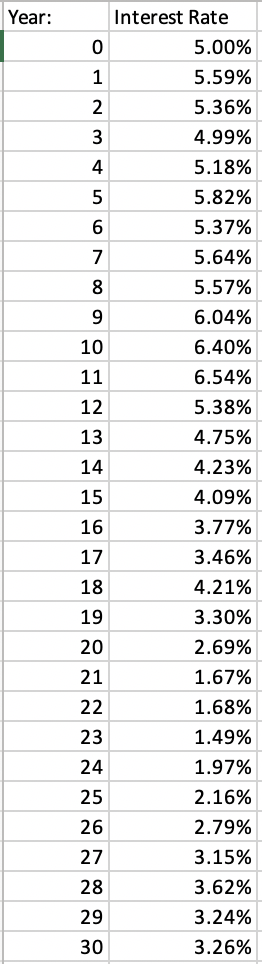

2. Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000. a. Calculate the price of the bond for different yields to maturity and times to maturity. Think about the price for yields from 5% to 15% and for maturities of 5 years to 30 years (in five year increments). (Do this by creating a data table, put the yields in the column.) b. Graph your results from part a. with yield to maturity on the x-axis and price on the y- axis c. What patterns do you observe? Why do you think this is the case? d. Do the same from above, but consider a 30 year bond in all cases and think about how the price of the bond changes in response to the yield for different coupon rates. i. Try coupon rates of 0%, 5%, 10%, and 15%. ii. Calculate percentage changes in price for each 1 percentage point change in yield. (what is the percentage difference in price if the yield is 6% instead of 5%?) e. What patterns do you observe in your answer to d? Why do you think this is the case? Year: 600 vu WNO 12 14 Interest Rate 5.00% 1 5.59% 2 5.36% 4.99% 5.18% 5.82% 5.37% 5.64% 5.57% 9 6.04% 10 6.40% 11 6.54% 5.38% 13 4.75% 4.23% 15 4.09% 3.77% 17 3.46% 18 4.21% 3.30% 2.69% 1.67% 22 1.68% 23 1.49% 1.97% 2.16% 2.79% 3.15% 28 3.62% 3.24% 3.26% 16 19 24 29 30 2. Excel Problem 2: Consider a bond with a 10% coupon rate and face value of $1,000. a. Calculate the price of the bond for different yields to maturity and times to maturity. Think about the price for yields from 5% to 15% and for maturities of 5 years to 30 years (in five year increments). (Do this by creating a data table, put the yields in the column.) b. Graph your results from part a. with yield to maturity on the x-axis and price on the y- axis c. What patterns do you observe? Why do you think this is the case? d. Do the same from above, but consider a 30 year bond in all cases and think about how the price of the bond changes in response to the yield for different coupon rates. i. Try coupon rates of 0%, 5%, 10%, and 15%. ii. Calculate percentage changes in price for each 1 percentage point change in yield. (what is the percentage difference in price if the yield is 6% instead of 5%?) e. What patterns do you observe in your answer to d? Why do you think this is the case? Year: 600 vu WNO 12 14 Interest Rate 5.00% 1 5.59% 2 5.36% 4.99% 5.18% 5.82% 5.37% 5.64% 5.57% 9 6.04% 10 6.40% 11 6.54% 5.38% 13 4.75% 4.23% 15 4.09% 3.77% 17 3.46% 18 4.21% 3.30% 2.69% 1.67% 22 1.68% 23 1.49% 1.97% 2.16% 2.79% 3.15% 28 3.62% 3.24% 3.26% 16 19 24 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts